WHAT is the point of buying shares? Ultimately investors must hope that the cash they receive from the company will offer an attractive long-term return.

Over the long run, reinvested dividends rather than capital gains have comprised the vast bulk of returns. But since the 1980s American firms have increasingly used share buy-backs, which have tax advantages for some investors. Buy-backs have been higher than dividend payments in eight of the past ten years.

In a buy-back, investors receive cash for a proportion of their holdings. A new paper* in the Financial Analysts Journal argues that adding this to dividend receipts to calculate a total payout yield gives a better estimate of future returns than the dividend yield alone. It also reveals a much better match between stockmarket performance and overall economic growth.

Using data going back to 1871, the authors find that the average dividend yield has been 4.5% and the total payout yield 4.89%. Since 1970 the dividend yield has dropped to 3.03%, but the total payout yield has averaged 4.26%. Looked at on that basis, the overall income return from shares has been not that far below historical levels.

The return from shares can be broken down into three components: the initial income yield; growth in the income stream; and any change in valuation. (If shares become more expensive, the yield will fall. Say the dividend is $ 6 and the share price is $ 100, the initial yield will be 6%. If the shares rise to $ 120, the yield will fall to 5% but the investors will have made a capital gain.)

Over the long run, changes in valuation levels do not make much difference to the return. What has driven stockmarket returns in recent decades is that total payouts have grown faster than before. The growth rate since 1871 has been 2.05%; since 1970, it has been 3.44%. That is probably because of strong corporate profits, which recently hit a post-1945 high as a proportion of America’s GDP.

An obvious apparent difference between dividends and buy-backs is that every shareholder gets the dividend but not all of them tend to take part in a buy-back. But theory suggests investors should gain from a share buy-back even if they do not take part. The buy-back will reduce the number of shares in issue, giving existing investors a proportionately larger claim on the profits and assets of the company.

Over time, buy-backs are offset by the shares companies issue to make acquisitions and honour executive share-option schemes. In the half century since 1970 new share issuance has exceeded buy-backs. But in the ten years to 2014, on average, buy-backs have predominated.

The authors also experiment with using the total payout yield as a yardstick of whether stocks are dear or cheap. By averaging the yield over ten years, they work out the cyclically-adjusted total yield (CATY) and compare it with the cyclically-adjusted price-earnings ratio (CAPE), which averages corporate profits. They find that CATY is at least as good as CAPE in predicting market movements.

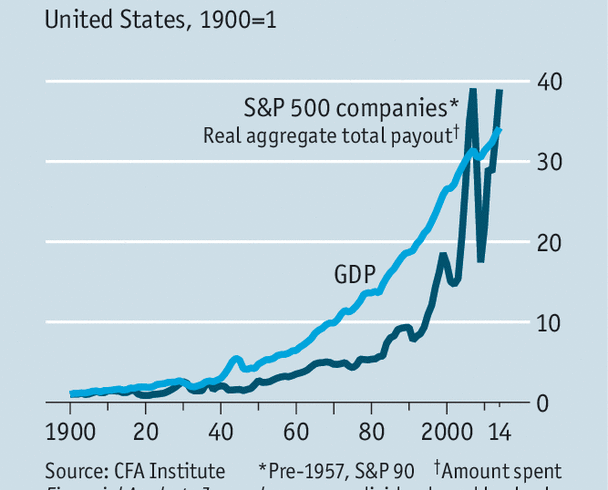

As for the link with economic growth, it is often hard to find a short-term correlation between this and stockmarket performance, which tends to be much more volatile. But the authors found that, over the very long run, growth in the aggregate payout from American equities has matched that of the country’s GDP (see chart), and payout-per-share growth has matched that of GDP per head.

There is no guarantee that this relationship will continue. Payouts lagged a long way behind GDP in the second half of the 20th century, and have only caught up because of the surge in buy-backs. And the stockmarket is much more international than it used to be; almost half the revenues of S&P 500 companies come from outside America.

Focusing on total payouts allows the authors to be a bit more optimistic in their forecasts of future returns than the traditional dividend-based approach would suggest. Historically, total payouts have grown by around 1.67% per year, compared with 1.46% for dividends alone. Combine that with the current payout yield and you get an expected future real return of 5.1%, compared with just 3.6% if dividends alone are used. Whether even that return, however, would be enough to meet defined-benefit pension promises, particularly those made to their workers by state and local governments in America, is another question.