Shutterstock photo

Shutterstock photoMany believe in the Fed/PPT’s Omnipotence

The thickness of intellectual dishonesty amongst pundits and analysts in this stock market needs a power-saw to be cut through. And nothing presents this perspective more clearly than the certain belief in the power of central banks to prop up our market. In fact, this past week, we even heard from Asher Edelman, as quoted on ZeroHedge, that he has ‘no doubt’ that the Plunge Protection Team – of which the US Central Bank is a member – is behind the stock market’s rally this year. But, this is no different than the exact same perspectives we read of many others who make the same claim about why the market is rallying well beyond anything they can understand.

First, the PPT was created to enhance “the integrity, efficiency, orderliness, and competitiveness of our Nation’s financial markets and maintaining investor confidence.” Moreover, it was only supposed to act when the market becomes “disorderly,” in other words, when the markets drop strongly. Yet, many are so perplexed by this current market rally, which will likely take us well over 2500 in the S&P 500, that they are grasping at straws to understand why we have come up this high when they did not foresee it. So, they have clearly regressed to blaming their lack of understanding about the market on the Tooth Fairy . . .er . . . I mean Peter Pan . . .er . . . I mean the PPT/Fed.

Fed/PPT are powerless during market declines

But, as I will show you below, not only have these entities been completely powerless during those strong market declines they are supposed to prevent, they are absolutely not the buyers which have pushed this market to the current levels.

Yet, amazingly, these same people who are so certain regarding the omnipotence of the Central Bank somehow believe that the market is on the precipice of a major crash. How can that be? If they truly believed in their own rhetoric about the Central Bank, they would be mortgaging their houses to put their money on the same side of the market they believe the Central Bank represents – in other words, they would be long and strong the stock market. I mean, if they are so sure that the market is rallying because of the Central Bank, why would they not invest alongside such a sure thing?

However, as we know, that is simply not the case, as they are often the most vociferously bearish voices in the market, which substantiates their intellectual dishonesty. Ultimately, this tells us that not even they believe their own rhetoric. And that is why all these people who talk out of both sides of their mouth should be summarily ignored.

But, I am about facts rather than beliefs, so let’s move to the facts.

While I will not even begin to discuss the failure of almost two decades of QE in Japan, this may be the poster child for the inability of a central bank to prevent major market declines. Many others have already discussed this at length, so I will not re-invent the wheel.

My focus is going to be upon the belief that the US Central Bank stands at the ready to prop up our financial markets at a moment’s notice or the common belief in its ability to crush the US Dollar. We will try to identify whether they are truly in control, or if it is merely an illusion due to the stock market simply being in a bull market on its own. Moreover, I will also present the failure of the Chinese Central Bank to effectuate the same.

Since 2009, we have been in a strong bull market in US equities. This bull market began after the US market completed an almost decade long sideways consolidation. So, has anyone even considered that QE simply coincided with the ultimate resumption of a 90 year larger degree bull market which began after the Great Depression? I believe so. Yet, most who believe QE caused this rally are beholden to the logical fallacy that correlation equates to causation. But, the last time I looked, QE has ended, yet the market has continued to rise.

Those who believe in the omnipotence of the Central Bank believe they stand ready to prevent market crashes. Not only was this proven to be untrue back in 2008-2009, we cannot even say it is true even during this bull market we have been experiencing since that time.

The advent of the “plunge protection team” back in 1987 was supposed to prevent disorderly market declines, like that experienced in 1987. So, let’s take a look at just how well the PPT/Central Bank has done to bring “order” to the stock market since that time.

Since 1987, I don’t think that anyone can fool themselves into believing that we have not experienced periods of significant volatility, despite the PPT/Central Bank being “on the job.” In fact, the following instances are just some of the highlights of volatility since the supposed inception of the Plunge Protection Team:

- February of 2001: Equity markets declined of 22% within seven weeks;

- September of 2001: Equity markets declined 17% within three weeks;

- July of 2002: Equity markets declined 22% within three weeks;

- September of 2008: Equity markets declined 12% within one week;

- October of 2008: Equity markets declined 30% within two weeks;

- November of 2008: Equity markets declined 25% within three weeks;

- February of 2008: Equity markets declined 23% within three weeks.

- May of 2010: Equity markets experienced a “Flash Crash.” Specifically, the market started out the day down over 30 points in the S&P500 and proceeded to lose another 70 points within minutes. That is a loss of 9% in one day, but the market did manage to close down only 3.1% in one day!

- July of 2011: Equity markets declined 18% within two weeks

- August 2015: Equity markets decline 11% within one week

- January 2016: Equity markets decline 13% within three weeks

Based upon these facts, you can even argue that significant stock market “plunges” have become more common events since the advent of the Plunge Protection Team, especially since we have experienced more significant “plunges” within the 20 years after the supposed creation of the “Team” than in the 20 year period before.

Fed/PPT are powerless in FOREX world too

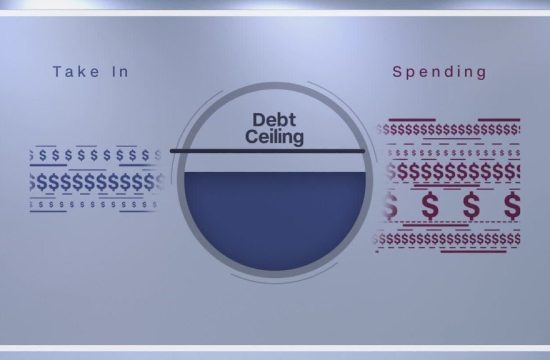

And, the Central Banks have not fared any better in attempting to control the FOREX world.

Back in July 2011, I was expecting a multi-year 3rd wave rally to take hold from the low 70’s in the DXY with an ideal target of 103.53.

Now, I want to remind you again that when I made this call back in July of 2011, the DXY hit a low of 73.42. So, that meant I was expecting a 41% rally in the DXY. And, in the FOREX world, that is a massive move.

Moreover, I also want to remind you that I maintained this expectation when the Fed was throwing their QE bazookas at the market. For this reason, almost all market participants at the time were quite certain that the dollar was going to crash. So, most viewed my call for a multi-year rally in the dollar as ridiculous, and that is putting it mildly.

So, even with all that QE being thrown at the dollar, we still saw the massive rally in the DXY that I was expecting. Yes, this was certainly counter-intuitive to common market expectations. But, this was a clear case study in the fact that the fundamentals or the Fed did not control this market, while market sentiment was the clear driver of price, as our analysis of market sentiment kept us on the correct side of what was an “unexpected” market rally.

Moreover, as the Fed began rate hikes, many were certain that it will be a catalyst for the dollar to rally strongly. However, I was looking for the dollar to enter into a multi-year pullback once we struck our long-term target. Now, despite the Fed raising rates, once the market slightly exceeded our long term target (the high struck in the DXY was 103.82, whereas our target from 2011 was 103.53), the DXY has been pulling back as we have expected. Yet, most who believe that the Fed controls this market seem to be in disbelief, as the DXY “should” be rallying when the Fed is tightening. But, the Fed is simply showing it lacks control of this market just as it does the equity market.

The same has happened with the Chinese Yuan. Recently, China spent 1 trillion US Dollars (a quarter of their FX reserves) over the past 3 years in an attempt to prop up the Yuan. However, the Yuan still lost close to 14% of its value against the USD over this time period.

Moreover, our lead analyst of our Forex Service at Elliottwavetrader.net, Michael Golembesky, appropriately advised a short in this market despite the Chinese “intervention.” In fact, Mike and I wrote several public articles on this potential trade. And, as you know based upon the downside price direction, he has been quite successful in that trade, even though most others in the market would not consider such a trade in the face of the unprecedented action by the Chinese government.

Ultimately, when truly tested, as in the situations above, the markets have moved completely opposite the “manipulation” attempts by the central banks. They have proven themselves powerless in the face of market forces. Ultimately, the market will do what the market will do despite the actions of the Central Banks. Believing otherwise is ignoring the truth in the market as presented by history and price action, and replacing it with the logical fallacy that correlation equates to causation. But, I can assure you that those that maintain these fallacious beliefs will feel significant financial pain when the next crash does occur and the Fed will be powerless to stop it.

See the chart illustrating the wave count on the U.S. Dollar (DXY) at https://www.elliottwavetrader.net/scharts/Chart-on-U-S-Dollar-DXY-201705261589.html.

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net, a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.