Shutterstock photo

Shutterstock photoAt the end of last year when the Fed, following a period of indecision, decided to embark on a path of cautious rate hikes, there was much talk of “divergence.†In this case, the word referred to the fact that here in the U.S., the Central Bank was tightening monetary policy while other major Central Banks, most notably the BOJ and ECB, were continuing on a path of ultra-low rates and adding liquidity by various asset purchases.

Within the last twenty-four hours we have heard from two Central Bankers, Kaplan of the Fed and Draghi of the ECB, and their comments make it clear that divergence of that nature is set to continue.

There is, however, another type of divergence taking place that traders and investors should pay close attention to. Stocks and bonds are sending completely different signals as to what the market is expecting for the second half of this year.

The stock market seems to be settling in for a period of sustained growth. We have seen a run of new highs in the major indices this year with very little volatility, a combination that is extremely positive for stocks.

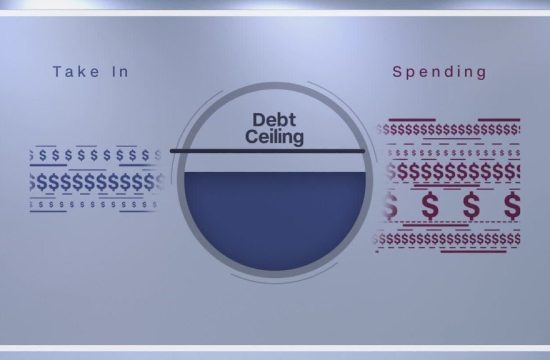

The bond market, however, is indicating some hesitation. There is almost unanimous consent that we will see another rate hike in June, but even though Kaplan said in his interview on CNBC this morning that he foresees another hike in December, bonds are indicating that there is less that a fifty percent chance of that coming about.

That could indicate that bond traders, and the economists they listen to, are not sure that the economy will be strong enough to withstand another rise in interest rates this year.

On Friday of this week we will get the latest clue as to which of those views is more accurate when the May jobs report is released. As was the case with the last report, the most closely watched numbers will not be the headline unemployment rate, nor the additions to non-farm payrolls. It has been clear for some time that the jobs market has, at least in a statistical sense, recovered from the recession, but so far it has done so by taking up slack and without adding inflationary pressure.

Such pressure would be indicated if there was any sharp move up in wage gains, so that often overlooked stat will be the focus of most people on Friday.

If there is any indication that wages are beginning to rise faster than to this point, it will make another hike from the Fed much more likely. Given Mr. Draghi’s insistence that the ECB will continue with its asset purchases to inject liquidity into the European economy that would mean that the Central Bank divergence was alive and well.

It would, however, signal an end to the divergence between stocks and bonds as the bond market would then move to price in another hike this year. Bond yields would rise and stocks could easily take a big hit.

All of this may seem somewhat esoteric to most investors, but regardless of what the jobs report reveals, it is likely to have lasting significance for U.S. stocks. If the employment market continues with its balancing act and tightens slightly without adding inflationary pressure, it will send a clear signal that we are on the right path, and that will give stocks another boost.

If, however, the need for further rate rises increases the divergence between the Fed and the rest of the world, we risk a situation where the U.S. economy moves from being the driver of global growth to being a drag. In that case stocks would be in for a rough summer.

The jobs report is always a significant data point, but this week’s will have even more lasting significance than usual. Divergence in the views between Central Banks and between the stock and bond markets both indicate that there is a disagreement on the strength of the continued recovery from recession. Friday’s data will give us a much clearer view of who has got that right, and should therefore be watched very closely.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.