Shutterstock photo

Shutterstock photoOPEC’s new strategy to balance the oil market is to cut oil exports to the U.S., a move intended to drain near-record-high crude oil inventories.

OPEC originally thought that six months of combined production cuts would be sufficient to balance the oil market, but the market still looks oversupplied. Not everyone agrees on this. The IEA has argued that we probably have already reached “balance,†which is to say, demand has caught up with supply. The energy agency says that the market is moving into a supply deficit situation in the second half of this year, if it hasn’t already.

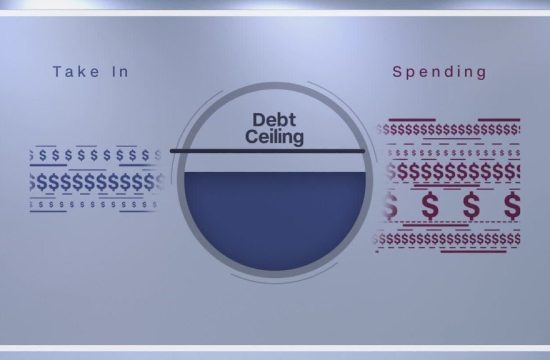

But the problem is that the one metric that OPEC officials themselves have held up as the key barometer to watch is the level of global crude oil inventories, rather than the immediate supply/demand balance. And on that front, they sort of shot themselves in the foot by ramping up exports just ahead of the implementation of the cuts late last year.

Elevated exports in November and December meant that huge volumes of oil started reaching U.S. shores in January. It is no wonder that U.S. inventories surged in the first quarter. The flood of oil set back OPEC’s efforts right off the bat, and even close-to-100-percent compliance on the production cuts was not enough to drain inventories at the speed needed to declare victory by June.

The huge increase in U.S. inventories means that OPEC needs six months just to get inventories back to where they started at the end of last year. “Producers unintentionally accelerated activities that would ultimately obstruct, and for a period reverse, the very rebalancing they were trying to accelerate,†Ed Morse, head of commodities research at Citigroup, said in April.

So, here we are, back at the starting line, this time with a promise of nine more months of cuts. OPEC’s strategy this time around is to directly target U.S. inventories, rather than simply taking barrels off of the global market. “Exports to the U.S. will drop measurably,” Saudi energy minister Khalid Al-Falih told reporters after the OPEC meeting last week. Some sources familiar with the Saudi strategy told Bloomberg that Saudi oil exports to the U.S. will drop below 1 million barrels per day in June, a reduction of 15 percent below the average so far in 2017. If the Saudis keep exports below the 1 mb/d threshold, it will be the lowest level of exports to the U.S. in years.

In a global marketplace, why does it really matter where the Saudis send their oil? In terms of global supply, a barrel sent to Asia is the same as a barrel exported to the U.S., so what’s the point of targeting the U.S., specifically?

The logic is that the U.S. has nearly real-time data on crude oil storage, unlike most other places in the world – data that is publicly available. Some analysts believe that oil inventories have been falling around the world for quite a while even as they climbed in the U.S., but because the markets pay close attention to U.S. data, the increase in U.S. inventories in the first quarter weighed on sentiment and prices. After all, nobody really knows what is going on with storage levels in China, for example.

But precisely because the U.S. has transparent data, Saudi officials believe that they can provide a jolt to the market but attempting to put a dent in storage tanks along the U.S. Gulf Coast. The strategy could have some merit. “The market has been given clear independent and verifiable metric of how Saudi cuts — and hopefully broader OPEC — are working out over the summer,†Amrita Sen, chief oil analyst at Energy Aspects Ltd., told Bloomberg.

It will take a bit of time for the effects to be felt. The typical transit time for an oil tanker from the Middle East runs from 35 to 55 days, according to Bloomberg, which means that the U.S. import data should start showing some signs of the strategy by mid-July. If imports drop off, that will mean more oil will have to be drained out of storage. When that occurs, oil traders will grow more confident that the market is on the mend.

Of course, if Saudi Arabia simply reroutes some of those exports to Asia, then inventories in Asia could rise. But, because the data is poor, the markets might not realize that the barrels originally destined for U.S. shores are not actually coming off the market but are turning up elsewhere.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.