Shutterstock photo

Shutterstock photoThe first revision to Q1 GDP has hit the tape this morning, and the results are a marked improvement over the disappointing initial read of 0.7%. The new figure is ratcheted up a half a percentage point to 1.2% – still no great shakes, but at least it’s passed 100 basis points. The Consumption read actually doubled, from 0.3% to 0.6%, and the Price Index dipped to 2.2% from its earlier 2.3%.

Expectations are much higher for Q2, largely based on seasonality. Q1 weather is almost always the worst of the year, and when seasonal businesses pick up in Q2 and beyond, we usually see stronger GDP reads. Also consider how holiday sales provides an economic boost to Q4 in a typical year, and you can see how a weak read in GDP – and 1.2% isn’t exactly strong, considering analysts and politicians alike have been openly tossing around 3-handle growth figure possibilities since at least Election Day last year – is not so big a deal when it’s Q1 in question.

April’s preliminary Durable Goods Orders posted a disappointing figure ahead of Friday’s opening bell, -0.7% as opposed to the +1.8% consensus estimate. What’s key beneath the headline are the reads when volatility is stripped out in various ways.

For instance, ex-Transportation costs, Durable Goods reached -0.4%. Ex-Defense spending, we see -0.8%. And goods orders, non-Defense, ex-Aircraft, posted +0.5%, unchanged month over month. Shipments versus Orders also disappointed at -0.2%, compared to the +0.5% expected.

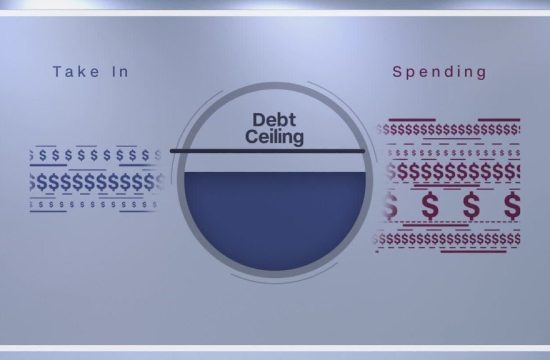

So it’s a data salad, no doubt, but these provide the steady diet for groups like the Federal Open Market Committee (FOMC), which will decide on whether to raise interest rates in just a couple short weeks. It may be a bit much to expect that today’s numbers will provide a “Goldilocks” environment for the FOMC to hold back a June raise – odds of a hike had been around 80% likelihood earlier this week – but as new economic data hits the tape now that Q1 earnings season is mostly behind us, economists and market participants will keep a close eye on how these reads affect policy going forward.

With the S&P 500 and Nasdaq coming off all-time closing highs Thursday, futures are down slightly ahead of the market open. With only a couple more trading days for the month of May, the Nasdaq looks to post its 7th straight month of index gains.

Ahead of the long Memorial Day weekend, look for volume to slow today. In fact, once June rolls around, market activity tends to roll off its heavier trading of the early part of the year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free reportThe views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.