Shankar Sharma and Devina Mehra, Co-founders, First Global in conversation with Ayesha Faridi of ET NOW.You were one of the early ones to catch on to say the specialty chemicals rally. You are a votary…

Whether Opec+ formally agrees, deeper crude oil cuts…

LONDON: Whether or not Opec+ oil producers formally agree to extra oil output curbs, rapidly filling storage capacity and plummeting demand due to the coronavirus crisis may force them to cut more. With crude consumption…

Big March selloff prompts mutual funds to lap…

Mumbai: Domestic mutual funds have been net buyers in the domestic equity market amid the brutal selloff, and heavily lapped up financial stocks all through March as valuations tumbled to historic lows thanks to the…

HDFC AMC pays Rs 4.2 crore to market…

MUMBAI: HDFC Mutual Fund and its top management have paid Rs 4.2 crore to the market regulator Sebi to settle the case of the fund’s investments in the debt instruments of Essel Group, which faced…

After US oil futures crash, what next?

A historic rout in oil markets sent U.S. crude prices plummeting to as much as minus $ 40 a barrel as traders rushed to get rid of unwanted stocks with storage capacity already overflowing amid…

Barnes & Noble stock soars 20% as it…

The board said Wednesday it had appointed a special committee to review offers. One came from longtime Barnes & Noble chairman Len Riggio. He is the company's largest shareholder, controlling close to 20%.Barnes & Noble…

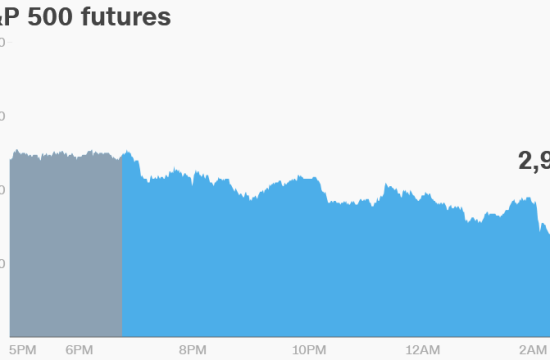

Premarket: 7 things to know before the bell

Click chart for more in-depth data. 1. The race to driverless cars: SoftBank (SFTBF) and Toyota (TM) are forming a joint venture that will use driverless-car technology to offer new services, such as mobile convenience…

RBI buys govt bonds in secondary market, signals…

The Reserve Bank of India has bought government bonds and treasury bills from the secondary market for the first time this year to push the yields down amid rising worries about a blow out of…

Group of non-bank lenders to issue pooled debt…

Kolkata: A group of non-bank lenders, including microfinance firms, is likely to issue pooled debt instruments such as bonds together to gain bargaining power on price as they are looking to tap the separate liquidity…