Medicines for dogs from Elanco (above) and Bayer (below) are available in an animal shelter on the treatment table of a veterinarian.Frank Rumpenhorst | picture alliance | Getty ImagesCompany: Elanco Animal Health Inc. (ELAN)Business: Elanco is an…

‘Big Short’ Steve Eisman likes the big US…

Renowned investor Steve Eisman said Thursday U.S. banks are an attractive investment following the coronavirus-induced market sell-off."I actually think long-term, the best cyclical play out there are the very large banks," Eisman, senior portfolio manager…

Big March selloff prompts mutual funds to lap…

Mumbai: Domestic mutual funds have been net buyers in the domestic equity market amid the brutal selloff, and heavily lapped up financial stocks all through March as valuations tumbled to historic lows thanks to the…

Investors should focus on banks with a comfortable…

G Chokkalingam, founder and MD, Equinomics Research & Advisory, prescribes a simple formula for investors looking for bets in the banking sector -- Look for ones that have net NPA of less than 4 per…

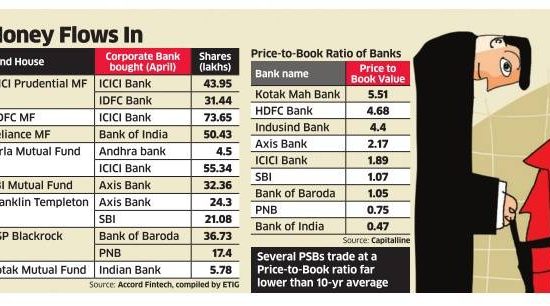

Mutual Funds increase bets on banks with corporate…

Mumbai: Fund managers are increasing their bets on banks with a bulky corporate lending book that have been largely ignored because of bad loan worries. Equity schemes of top mutual funds lapped up shares of…

Moody's raises outlook for Singapore banks to stable,…

Moody's Investors Service raised Singapore banks' outlook to stable from negative on Wednesday, citing stabilizing commodity prices and improving growth conditions.The ratings agency said deterioration in the asset portion of balance sheets had peaked, particularly…

Banks urge RBI to soften qualifying norms for…

MUMBAI: Beleaguered bankers on Tuesday demanded that the Reserve Bank of India ease conditions on loans that would qualify for restructuring under the so-called S4A scheme and permit them to spread the losses arising out…

Schedule I Canadian Banks – (Part 1 Of…

Shutterstock photoBy Charles Fournier :All figures are expressed in Canadian dollars unless otherwise noted.IntroductionBank of Montreal (NYSE: [[BMO]]), Canada's 4th largest bank by market cap, reported Q2 2017 results on May 24th. Despite reporting relatively…

If bad debt doesn't rise during hard times,…

Many banks in Asia have seen asset quality deteriorate in a difficult post-crisis climate, but the rise in non-performing loans should be assessed in the context of that environment, Singapore's central bank chief said on…