Ajay Tyagi, Executive Vice-President and Fund Manager for Equity at UTI AMC, busts a few myths about equity investing in bear markets, mutual fund SIPs and the so-called bad patch for financial stocks. Read on…

How difficult is it to manage an equity portfolio in a bear market with incremental flows? How are you convincing your customers to stay invested when they see their hard-earned money deplete?

On the contrary, getting incremental flows in a bear market is certainly a positive for many reasons.

First, bear markets open up attractive opportunities across sectors and even high quality businesses start to trade at attractive valuations. Secondly, given the polarised state of bear markets with more sellers than buyers, the risk of impact cost while building positions in not so liquid stocks goes down substantially. Finally, as a result of the above, it gives the confidence to a fund manager as well as the fund house that investors would earn more than average returns by investing into the markets that are trading at lower-than-average valuations.

It is part of our job to keep educating investors about the merits of systematic investments through bull and bear phases of the market. By sharing long range data with our clients and explaining to them that they are getting the same businesses at a substantially lower valuation, we try to zoom out their attention from near-term pessimism and keep reminding them of the longer-term wealth creation potential of equity as an asset class.

In fact we try to prove to them that while it is painful to see the value of their portfolios erode, the fact remains that the more they invest in such bear markets, the better would be their longer-term returns, which can help them accomplish their goals faster.

We always hear SIPs are the best way to enter equity, more so in bear markets. But if we calculate the five-year SIP return even in the fund you manage, it is not even 4 per cent. On hindsight, bank FDs would have been much better. Why should an investor opt for SIPs today?

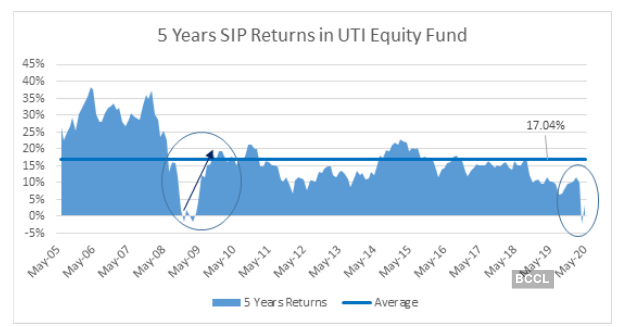

It is certainly not correct to look at SIP returns after a deep correction in the market and pivot oneself to that. To visualise the complete picture, let’s look at the graph below that shows the trend of five-year SIP returns (CAGR) in UTI Equity Fund in last 15 years.

The returns are taken at the beginning of each month and there are a total of 180 data points. There are a few important observations that can be made by analyzing this data, which reinforces our confidence that SIP is indeed the best way for investors to build a portfolio.

· First, five-year SIP returns over the past 15 years were in the negative zone only on three occasions (December 2008, March 2009 and Mach 2020) i.e. less than two per cent of the times.

· Secondly, five-year SIP returns over the same period were less than five per cent only on nine occasions i.e. 5 per cent of the times and were less than 10 per cent only on 21 occasions i.e. less than 12 percent of the times.

· Finally, the average five-year SIP returns over the above period has been 17.04 per cent, which is indeed substantially higher than bank FDs.

While looking at the five-year return in the negative zone can be very painful, it is important to keep up the discipline. For instance, while in December 2008, the five-year SIP returns had turned negative, the courageous investor who had kept the faith was greeted by a very satisfying 20.80 per cemt return on his five-year SIP by December 2009.

With the coronavirus-induced lockdown being eased gradually, the focus is on revival. Which sectors of the economy do you think will be the first to revive?

While it is difficult to say with certainty, as it is still an evolving situation, our guess is consumer staples, select consumer durables and pharmaceutical sectors would be the first to revive. While auto is a discretionary sector and intuitively should take time to revive, but the experiences of China and Korea post lockdown has indicated that consumers would prefer personal mobility to public mobility, which could lead to demand revival.

Finally we have to be watchful of the government stimulus to revive a few sectors in order to have the highest multiplier effect for reviving economic growth.

You have been reducing banking stocks recently. Can I safely say Ajay Tyagi is bearish on banks and financial stocks?

We had increased our ‘underweight’ position in the financial sector for almost a year up to February 2020. However ever since the steep correction started in the financial sector (banks as well as NBFCs), we have been increasing our exposure to the sector again. It was and shall continue to remain the highest weighted sector in our portfolio. We feel if India is to get back to 6-7 per cent real GDP growth, then credit growth would have to be around 15 per cent. Economic growth and credit growth are highly intertwined. It would be incorrect to say we are bearish on the financial sector. In fact we are bullish on the sector notwithstanding the near-term asset quality pressures.

However we are very selective in building our exposure in this sector with quality of underwriting through the past-economic cycles being our guiding light. It is for this reason that more than 80% of our exposure in this space is now in high quality banks and NBFCs like HDFC Bank, Bajaj Finance, HDFC and Kotak Bank.

Retail and pharma have found favours with you recently. Do you think they will continue to grow despite surging so much already?

We have been bullish on the pharma sector for a long time. In fact, this has been our highest overweight sector for a long time now. While it is difficult to predict near-term price movements, we continue to remain bullish on the sector from a medium to long-term perspective. Although India’s healthcare spends are highly under-indexed right now, we feel that as per capita income increases, spend on healthcare would certainly increase. This sector has a long growth runway along with reasonably strong balance sheet and cash flows. Further price erosion is the US generics market is also abating, improving the economics of that market.