By Sarah Ponczek

Trend-following funds have been at the forefront of the stock rally and are likely to drive further gains.

So-called quant funds know as commodity trading advisers (CTAs) have been covering their short positions since early March, pumping $ 380 billion into global equities, according to Charlie McElligott, cross-asset strategist at Nomura Securities. Still, there’s more short covering to be completed, creating room for the stock market momentum to run.

“CTA Trend buying has been a mammoth source of ‘buy to cover’ flows in global equities,†McElligott wrote to clients Thursday. “Yet there is still more fuel for the fire.â€

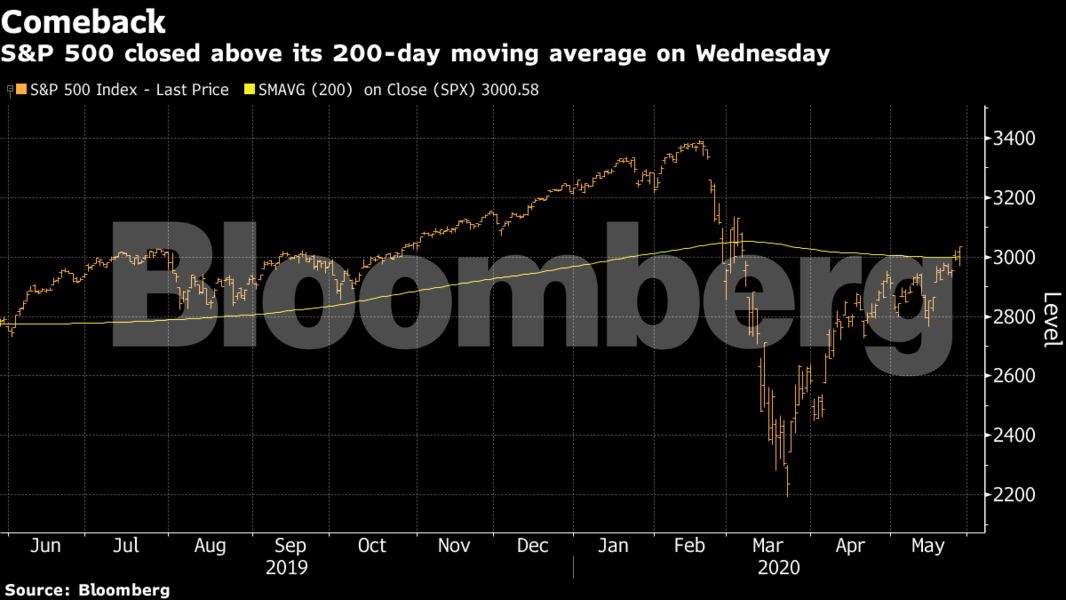

The S&P 500 Index has surged more than 35 per cent since a low in mid-March amid efforts to reopen economies shut by the coronavirus pandemic and massive doses of monetary and fiscal stimulus. It’s still 10 per cent below a record reached in mid-February.

Bloomberg

McElligott’s model for tracking the quant funds signaled a flip in their strategies from 50 per cent short to 100 per cent long yesterday for S&P 500 futures, potentially triggering $ 17 billion in purchases. The benchmark cash gauge went on to gain 1.5 per cent and closed above 3,000 and its 200-day moving average for the first time since early March.

CTAs are still wagering against small caps, though, at 50 per cent short. They may flip to buying if the Russell 2000 climbs about 6 per cent to 1,522.71, according to McElligott.

“Some remarkable things occurring over the past few sessions — particularly within the US equities space, as it pertains to consensus positioning and what looks to be a tectonic ‘de-grossing’ of short books and overall dynamic hedges,†he wrote.