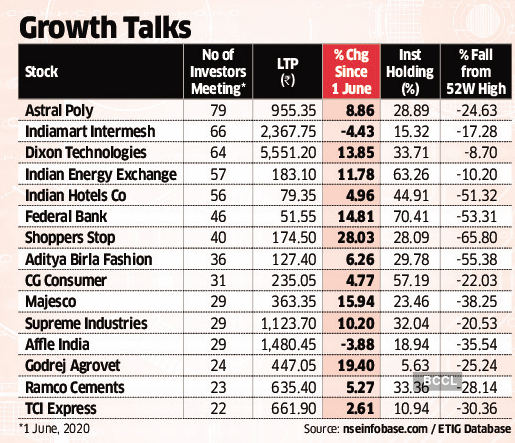

Mumbai: Is there a strengthening co-relation between companies’ investor meets and the performance of their share prices? It may be a soft indicator for now but a study of the performance of shares around the time the company discloses its scheduled meetings with investors shows prices do move up in the period. Companies are required to disclose meetings with investors to stock exchanges. Out of the 15 mid-cap companies that have seen the highest number of investor meetings in June, shares of 13 have risen between 2 per cent and 28 per cent in the period.

There are a few explanations here. It is possible that some of the institutional investors who met the companies would have gone ahead and invested after the meetings.

A meeting, however, need not translate into an investment. Another possibility is that traders have mopped up shares to make a quick buck in anticipation of investments by influential names that could prop up prices.

For instance, 79 fund managers and analysts from various funds including Capital International, Amansa Capital, Tokio Marine AMC among others held meetings with the management of plastic pipe manufacturer Astral Poly Technik in June. The stock rose 8.86 per cent in the period. Meanwhile, Shoppers Stop met 40 investors and analysts but its stock jumped 28 per cent.