By Raveendra Balivada

Before we start this article, let’s do a bit of time travel (Avenger Endgame style)! On January 1, 2020, even though the economy was not at its best, it was still doing good. People were going to offices, businesses were being run as usual, and in fact, everything was going on as normal as they could. But come March-April, 2020, Dolphins and various other wild animals started paying us a visit (at places where you would have never imagined them) and of course, the lockdown happened.

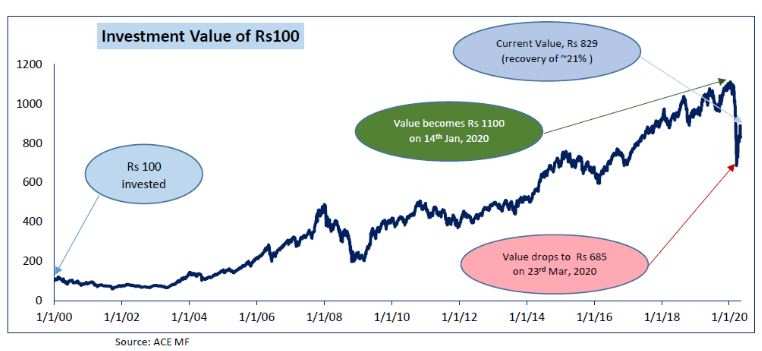

In the past couple of months, the bears have wreaked havoc in equity and debt markets! From a January 14 peak (17,349, Nifty50 – TRI), the indices fell to its lowest on March 23 (10,710, Nifty 50 – TRI), an unprecedented fall of almost ~38 per cent. TRI prices in dividend on the index into the price level. This brutal and swift correction left everybody with a common question in mind†should he/she keep on investing in the market?

We did some number crunching on past data and found out some interesting facts:

- Let’s start with the very basic one. What would an investment of Rs 100 made at the beginning of this century (invested on January 1, 2000) would have become today? The current value of that investment would have been Rs 829 on May 5. The value of the same investment would have become Rs 685 on March 23 and Rs 1,100 on January 14. As such, from the bottom of March 23, the index has already recovered ~21 per cent as of May 5.

ET CONTRIBUTORS

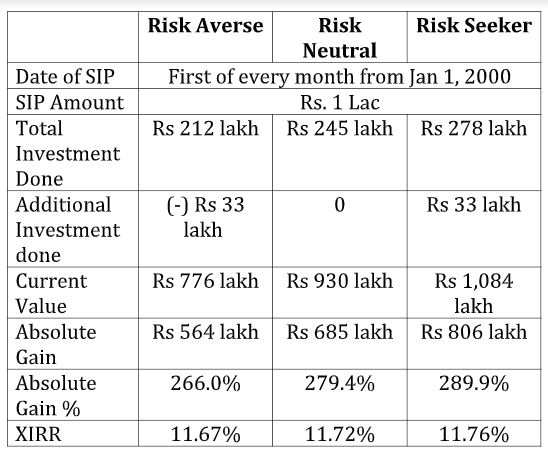

But this is just one-shot investment. How would things have been if the same person did a series of investments via SIP? We have an answer to that question as well! Let’s say an investor did an SIP of Rs 1 lakh at the start of every month, right from January 1, 2000. Let’s look at how it plays out for the investor in three different scenarios (the major consideration taken while doing the calculations in these scenarios is, one could not predict the fall/ rise in the market but one can definitely act after witnessing the fall/ rise):

- Risk-averse scenario: Suppose, whenever the investor witnessed a fall of more than 5 per cent, he/ she would pause the SIP for next month, i.e. if the market fell 8 per cent in April 2011, he will pause the SIP for May, 2011

- Risk-neutral scenario: irrespective of the rise/ fall in the market, the investor never bothered to change his/her SIP

- Risk-seeker scenario: whenever the investor witnessed a fall of more than 5 per cent, he/ she will invest an additional amount in the SIP in three tranches during the next month, i.e. if the market fell 8% in April, 2011, the SIP schedule of the for May’ 2011 would look something like this:

- May 1, 2011 – Rs 1 Lac

- May 7, 2011 – Rs 0.33 Lac

- May 14, 2011 – Rs 0.33 Lac

- May 21, 2011 – Rs 0.33 Lac

To keep things in perspective, there would have been 33 months where the returns have been lower than -5%. And here is how their investment summary would look like (From Jan 1, 2020 till May 1, 2020):

ET CONTRIBUTORS

Before anyone frowns and says that on an XIRR level, there is hardly any difference, Let’s decipher the result:

- While it is true that on an XIRR (extended internal rate of return) level, there is a minor difference, but one must not forget that this XIRR is for 20 years, and considering the law of compounding in the picture, the absolute gains become quite huge

- Also, don’t lose sight of the fact that with an additional investment of just Rs 33 lakh, there is an additional gain of Rs 154 lakh (or a Ferrari??)

- Similarly, the additional investments done in the bear market (or trying to do a bottom fishing) yielded a difference of more than ~10% on an absolute basis

- The opportunity cost for the risk-averse person (who happens to pause his/her SIP for 33 months) is huge, if one compares the absolute gain figure with risk-neutral and the risk-seeker investors.

Still worried about continuing your investments?

We would suggest putting that thought to rest and keep on investing. As they say, patience pays, likewise your investments will too!

(Raveendra Balivada is Head of Investment Advisers at HDFC Securities. Views are his own)