Mumbai: India’s most-valued company Reliance Industries (RIL) is now the 60th most-valued firm in the world, climbing 13 places from end of 2019.

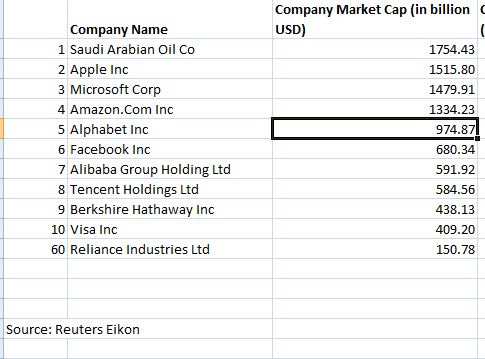

The company with a market capitalization of $ 150.78 billion has risen past the likes of Unilever, Astrazeneca and McDonalds and ranks 60th in terms of market capitalization in the world, data from Reuters Eikon showed. Oil major Saudi Aramco tops the charts.

The company is just ahead of UK’s Unilver and lags behind US pharma major Eli Lilly & Co.

It has more than doubled from its 52-week low of 867.45 seen on March 23, as it went on a spree of marquee deals for its coveted unit Jio Platforms, and saw a its rights issue, the country’s biggest, sail through.

RIL raised more than Rs 1,68,818 crore in just 58 days through Rs 1,15,693.95 crore collected from investors in Jio and another Rs 53,124.20 crore from a rights issue. Along with the stake sale to BP in the petro-retail joint venture, the total fund raised is in excess of Rs 1.75 lakh crore.

The stock currently has 17 strong buy, 8 buy, 3 hold, 3 sell and one strong sell rating, data from Reuters Eikon showed.

On June 17, JP Morgan re-initiated coverage on the stock with a neutral rating, and a price target of Rs 1,490.

The brokerage said RIL’s re-rating on the Jio Platforms stake sale and the potential from a digitized economy is likely to continue, even though in the near term one may not see earnings from any of the initiatives.

“The stock price drivers would remain with JPL (Jio Platforms), and while RIL’s retail business is the largest in India and growing, we believe investor focus would be squarely on how JPL rolls out the various digital businesses,†JP Morgan analysts said in the note.

“With earnings unlikely to be a driver of the stock price (given muted refining, petchem), and the critical news flow on the JPL stake sale now behind us, we would expect the stock to consolidate after its significant outperformance from the March lows,†they added.