By Nupur Acharya

Indian stocks have an opportunity to outperform emerging markets as ample liquidity and strong sentiment favor more gains, according to Morgan Stanley India Co.

“Given the sharp rally over the past few weeks, volatility will likely increase with the probability of a tradeable correction in stocks,†analysts Ridham Desai and Sheela Rathi wrote in a note to clients. “We are a buyer of any such correction — there is likely more upside on stocks in the coming months.â€

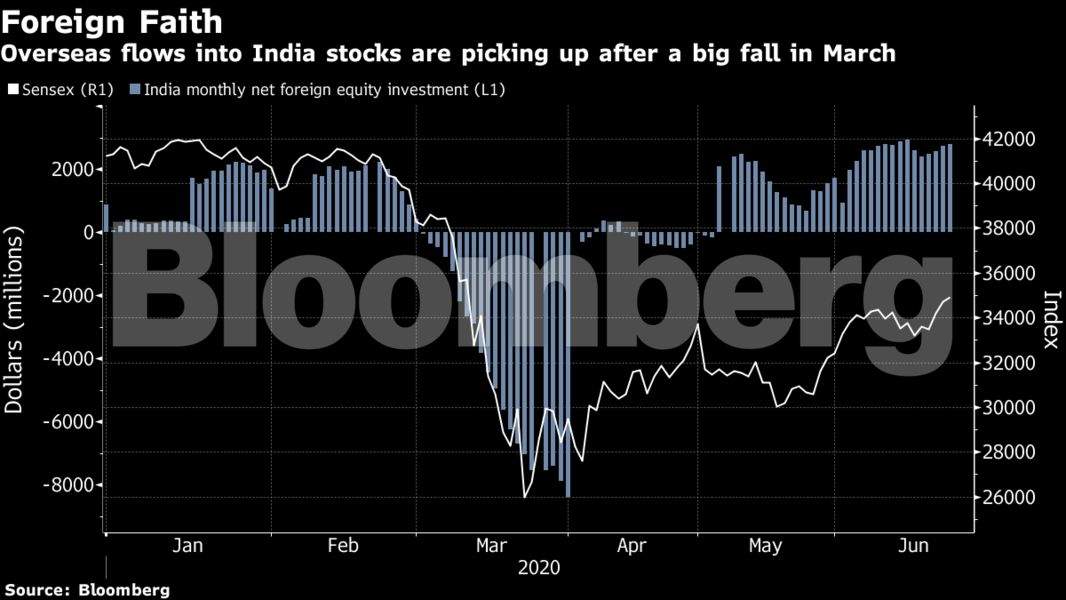

The S&P BSE Sensex has rebounded 34% from its March low but is still down 15% for the year, compared with a 9.7% dip in the MSCI Emerging Markets Index for 2020. Indian stock volatility has come down from recent panic levels but remains elevated. Foreign investors have started to return after pulling out a record $ 8.4 billion in March as Covid-19 forced the world’s most extensive lockdown.

The recovery has been aided by the gradual reopening of the economy as well as government stimulus measures. Growth in local retail investing has also helped, notably helping smaller stocks reverse their underperformance of recent years. Gauges of mid- and small-cap stocks have climbed 36% and 42% from their March lows.

“The time has come to move away from the macro and shift to stock picking as a strategy,†the analysts said. “We expect market performance to broaden and like mid-caps.â€

Bloomberg

The broker favors a “barbell portfolio†with a mix of quality companies at reasonable prices and stocks that are linked to macroeconomic changes. It is overweight consumer discretionary, health care and energy while underweight technology and staples. It remains neutral on financial companies, which it expects are likely to lose leadership in the broader equity market.