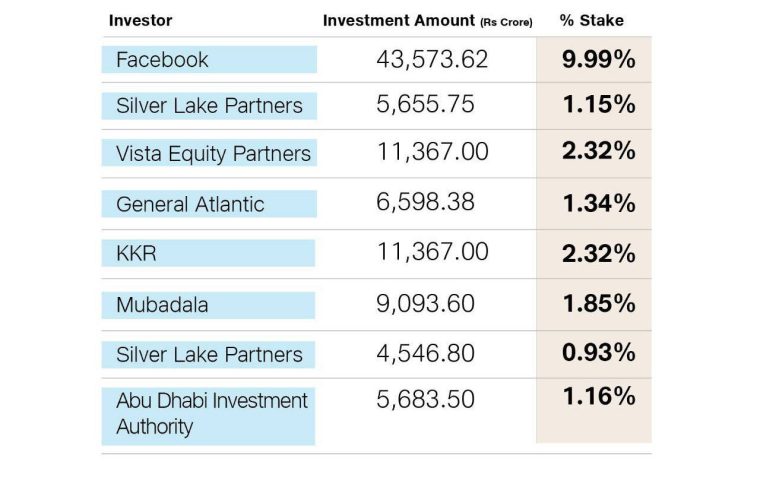

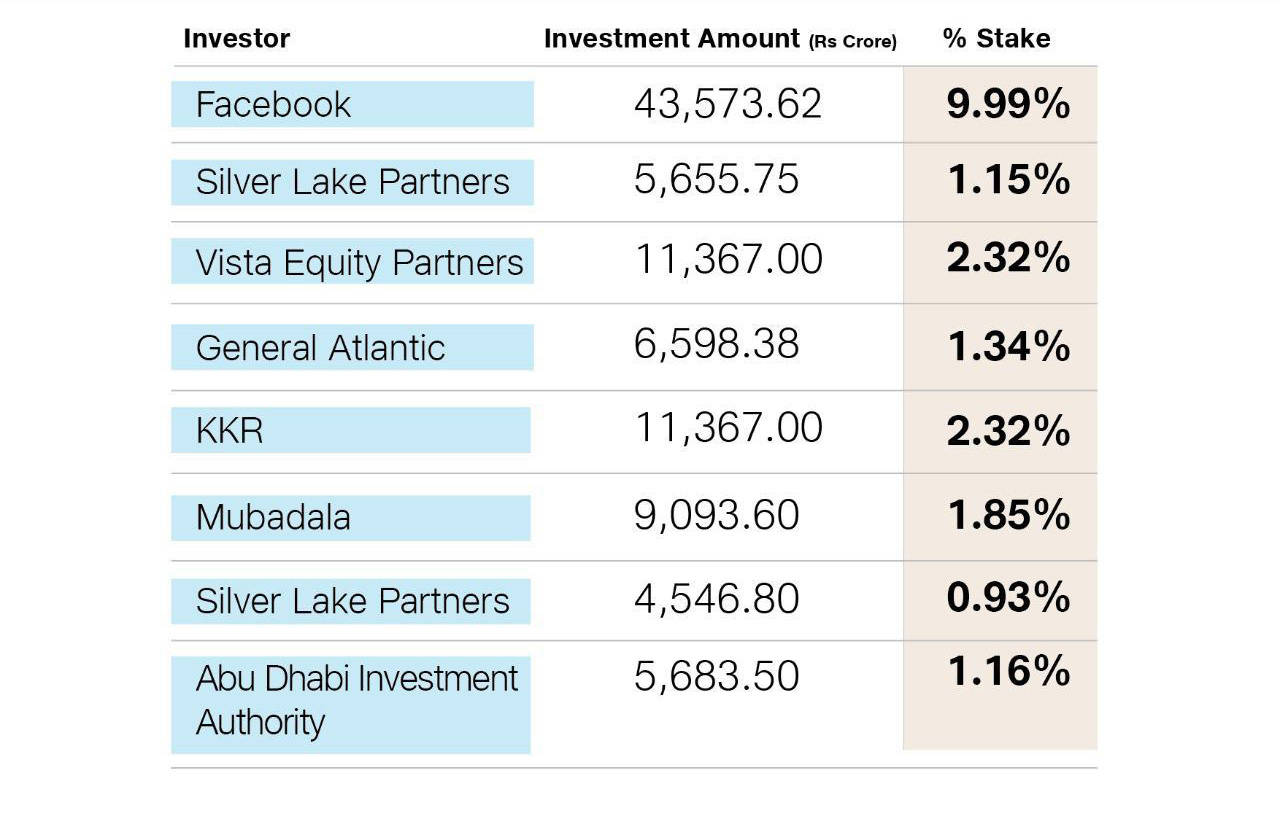

Jio Platforms is set to raise an additional Rs 5863.50 crore from Abu Dhabi Investment Authority (ADIA) by selling 1.16% equity stake. ADIA is now the seventh investor to pick up a stake in the Mukesh Ambani led company in seven weeks.

This investment pegs Jio Platforms’ equity value at Rs 4.91 lakh crore and enterprise value at Rs 5.16 lakh crore and with this latest tranche , Reliance Industries stands to get Rs 97885.65 crore from eight deals in exchange for a 21.06 % stake.

ADIA follows Mubadala Investment Co., , the sister firm of the UAE’s largest sovereign wealth fund in its investments in Jio Platform. Last Friday, Mubadala’s investment of Rs 9,093.6 crore in Jio for 1.85% stake was announced. ET had reported about both the deals on June 2.

“I am delighted that ADIA, with its track record of more than four decades of successful long-term value investing across the world, is partnering with Jio Platforms in its mission to take India to digital leadership and generate inclusive growth opportunities. This investment is a strong endorsement of our strategy and India’s potential,” said chairman and MD -Mukesh Ambani.

Agencies

ADIA is part of a consortium that has been engaged with Reliance for months to buy into its pan-India fibre network. It is also a rare case of both UAE funds scoping the same investment opportunity.

The funds coming from stake sales in Jio Platforms and the Rs 53,124 crore from a rights issue will help lower Reliance’s consolidated net debt by over 90% from Rs 1.61 lakh crore at the end of FY20. Reliance is now well placed to meet its zero net-debt target by March 2021, analysts said.

Before ADIA, other investors in Jio include -Facebook and private equity funds Vista Equity Partners, General Atlantic, KKR, two tranches from Silver Lake and then Mubadala.