Apple and Tesla have both announced stock splits recently and CNBC’s Jim Cramer on Wednesday revealed 10 stocks of companies that he would like to see follow suit to reduce high trading prices.

The stock split, in which a company increases substantially its number of outstanding shares while preserving its market value, will attract and give more ownership access to retail investors whose investment options may be more limited to low-dollar stocks, the “Mad Money” host said, directing his message to some of the leading tech executives.

“If you want the market to keep climbing, these ten companies — and many more — need to start taking their cue from … Tim Cook and Elon Musk,” Cramer said. “Remember, the size of the price tag matters with this [young investing] crowd” and “you want this no-commission paying crowd in your stock.”

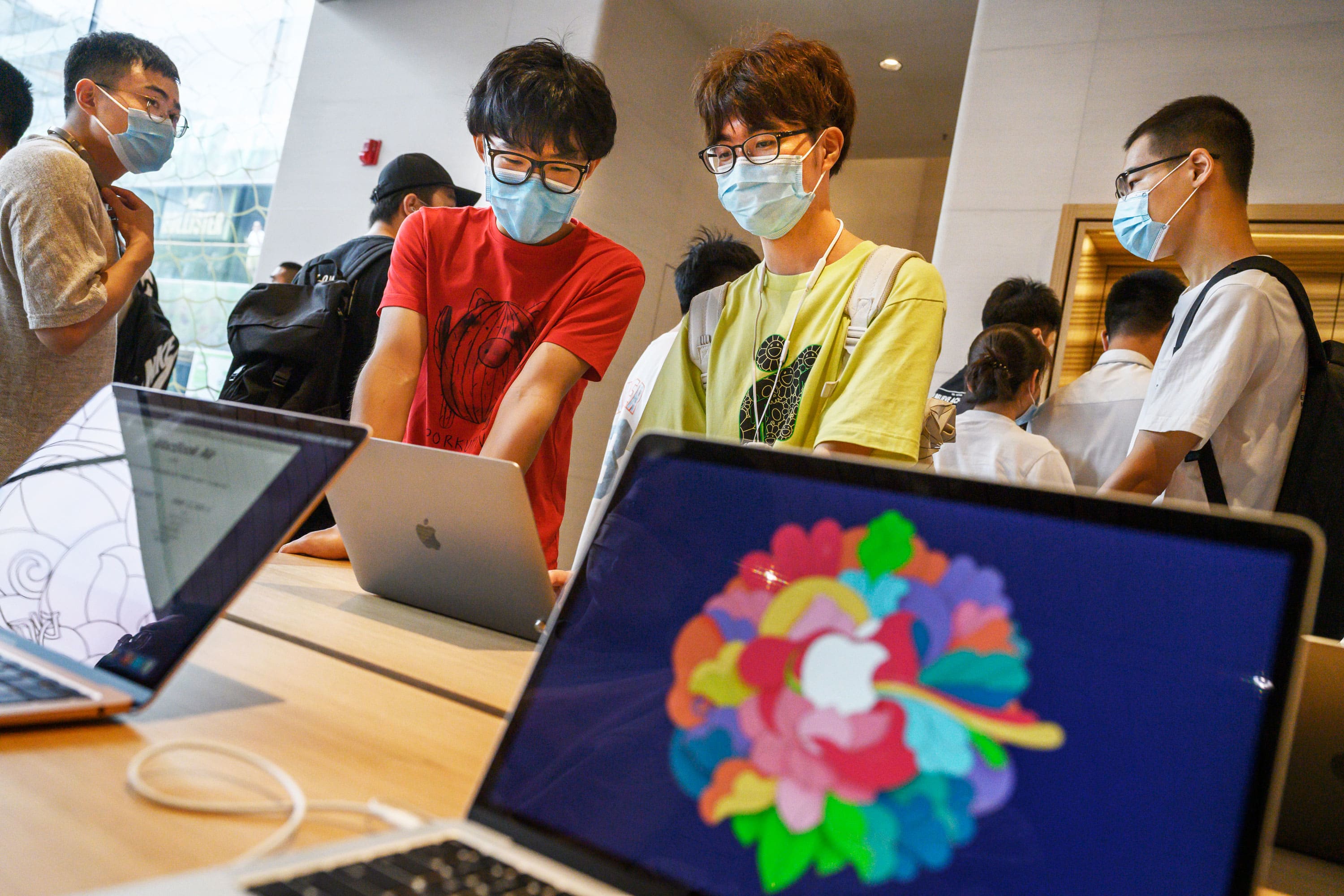

Apple, who announced late last month that it will split its stock for the fifth time in its public history, plans a 4-for-1 split for Aug. 31. The split, hypothetically, would reduce the stock price as of Wednesday’s close from $ 452.04 to $ 113.01 per share.

Tesla, which announced a 5-for-1 stock split that will also go into effect Aug. 31, hypothetically would see its Wednesday’s closing price of $ 1,554.76 trade below $ 311 per share.

One stock in Apple will be worth four after the split. As for Tesla, one stock would be worth five post-split.

“In short, splits are good for home gamers, bad for professionals” and “we know what happens after the split. This new cohort of investors, the ones who love low-dollar amount stocks, will start buying and holding these best-of-breed names rather than the darned penny stocks,” Cramer said.

“They’ve been ignoring these … And the thing about retail investors is that they can make for a more stable shareholder base than hedge funds because the pros have no loyalty.”

Below is a list of companies, alongside their Wednesday closing prices, that Cramer would like to see divide their existing shares into new shares and boost liquidity:

Disclosure: Cramer’s charitable trust owns shares of Apple, Amazon, Alphabet, Costco, Nvidia, Facebook and Microsoft.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com