By Anirban Nag and Rahul Satija

India’s credit rating moved one step closer to junk after Moody’s Investors Service downgraded the nation to the lowest investment grade level and surprised economists by keeping it on a negative watch.

Moody’s reduced the long-term foreign-currency credit rating to Baa3 from Baa2, with the outlook implying it could cut the rating further. The action brings its rating in line with the BBB- assessment from S&P Global Ratings and Fitch Ratings Ltd.

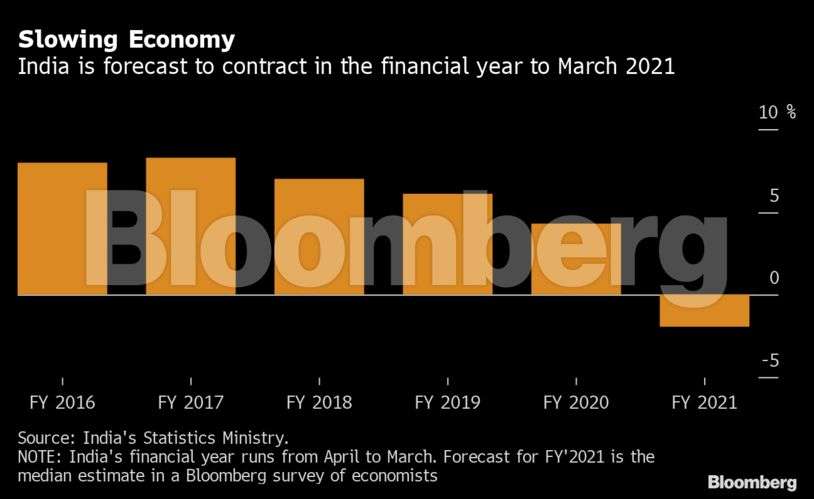

The economy is facing its first contraction in more than four decades and a fiscal deficit blowout as the coronavirus pandemic spreads. Moody’s said India’s growth and credit profile were deteriorating even before the virus outbreak and those risks will become more pronounced now.

Bloomberg

“The downgrade doesn’t come as a surprise,†Radhika Rao, an economist at DBS Bank Ltd., wrote in a note. “The decision to retain a negative outlook, however, is a concern, as it keeps the door open for further downshift.â€

The negative outlook reflects strong downside risks from deeper stresses in the economy and financial system, Moody’s said. Those threats could lead to a more severe and prolonged erosion in fiscal strength than estimated earlier, it said.

What Bloomberg’s Economists Say

“The risk of another downgrade hanging over India is clearly not positive for external borrowing costs for the government or corporates. Even so, we think investors are well aware of the challenges facing India’s economy and policy makers. And our assessment of the root problems differ significantly from the view Moody’s presented.â€

— Abhishek Gupta, India economist

The focus now shifts to S&P and Fitch, and whether they will lower India’s rating outlook to negative or downgrade to junk, Samiran Chakraborty, an economist at Citigroup Inc. in Mumbai, wrote in a note.

“Given the challenges to revive growth, we will not be able to rule out the possibility of a rating downgrade by the other two agencies though timing would be difficult to predict as the first step is likely to be an outlook change,†he said.

Richard Noonan, a spokesman for S&P, declined to comment on the timing of their rating review.

Muted Markets

With India opening up its high-yielding debt market to foreigners, any downgrade by S&P and Fitch would hurt inflows into a nation that relies on imported capital to fund investment.

Indian assets took Moody’s action in their stride. Sovereign bonds were marginally lower, while the rupee was steady. Stocks are headed for their longest gaining run since November amid optimism that the easing of nationwide lockdown will help businesses.

The government reopened large parts of the economy to revive growth, Prime Minister Narendra Modi told a gathering of industry captains Tuesday. India will definitely get its growth back, he said.

Read More: Traders Pin Hopes on RBI Support After Moody’s Cuts India Rating

Pressure on the credit rating may reduce the likelihood of the central bank buying bonds directly from the government to help finance the fiscal deficit.

“The government will be more cautious about direct monetization in the primary market,†said Abhishek Goenka, chief executive at India Forex Advisors Pvt.

?Moody’s action reverses its surprise upgrade in 2017 following the passage of the goods and services tax and bankruptcy reforms. The ratings company cut India’s outlook to negative within two years as growth sputtered and a shadow banking crisis played out.

“India faces a prolonged period of slower growth relative to the country’s potential, rising debt, further weakening of debt affordability and persistent stress in parts of the financial system,†Moody’s said Monday. These are risks “the country’s policy making institutions will be challenged to mitigate and contain.â€