Good evening, ETtech reader.

In today’s edition, we’re covering what India’s Economic Survey 2020-21 has to say about the country’s startup ecosystem and how the Covid-19 pandemic and subsequent lockdowns have made India one of the largest gig economy hubs in the world.

Meanwhile, the government today notified the Startup India Seed Fund Scheme.

Here’s a look at the must-read top tech news today.

1. Eco Survey on Indian startups

The government has recognised 41,061 startups as of December 23, 2020, according to the Economic Survey 2020-21 tabled in Parliament on Friday.

The story so far: India currently houses the world’s third-largest startup ecosystem, with 38 firms valued at more than $ 1 billion. In 2020, the country minted 12 unicorns despite the economic disruption caused by the Covid-19 pandemic.

Why it matters: In recent years, the central government has taken several measures to support startups—including simplifying regulations, providing income tax exemptions and setting up a Rs 10,000 crore fund-of-funds for startups operated by Small Industries Development Bank of India (SIDBI).

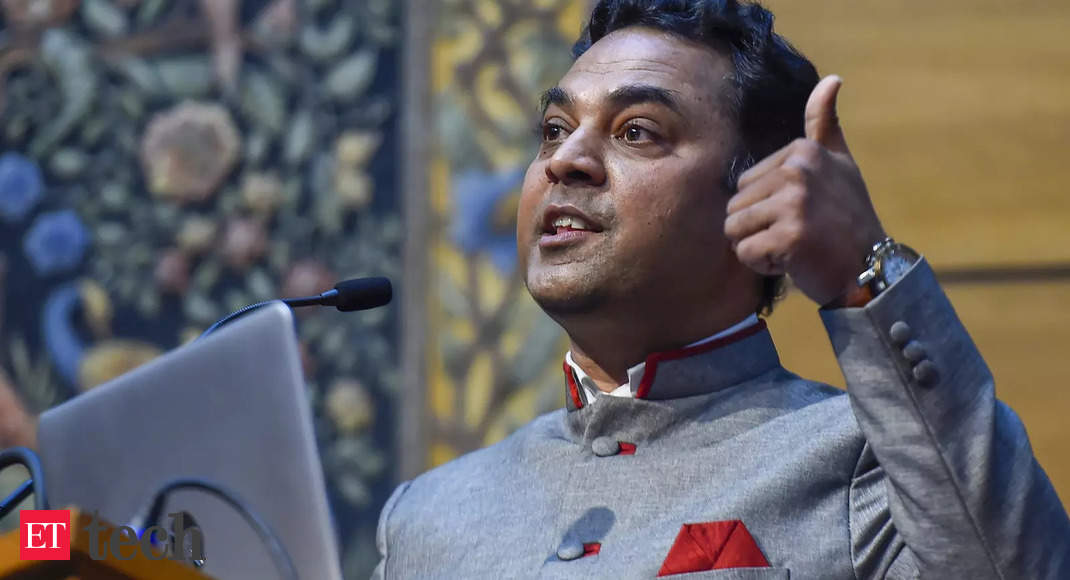

At the sixth ET Startup Awards earlier this month, Union Commerce and Industries Minister Piyush Goyal called upon the Indian industry to set up a Rs 10,000 crore fund for early-stage financing as overseas investors are picking up large stakes in startups.

2. Covid spurs gig economy

India has become one of the largest markets for flexi staffing in the world due to the wider adoption of e-commerce and online retailing, according to the Economic Survey 2020-21.

Why it matters: The lockdown period also saw employers trimming staff and engaging freelancers to reduce overheads. Contracts for gig workers are typically shorter and more specific to a task or job and the gig economy allows for flexibility in employer-employee relationships.

Earlier this month, ET reported that while tech-enabled gig platforms are still evolving, their business models often force companies to offer workers an unfair deal. This results in churn, adding to the woes of the companies, which are already grappling with their unique problems and are dependent on external funding.

Also Read: India Inc is going big on Gig economy

Tweet of the Day

This is unacceptable.We now need to know more about @RobinhoodApp’s decision to block retail investors from purch… https://t.co/tTVEZYkuXN

— Alexandria Ocasio-Cortez (@AOC) 1611851784000

3. Seed fund scheme for startups

The government has approved the Startup India Seed Fund Scheme (SISFS) with a corpus of Rs 945 crore to assist startups.

Why it matters: The funds will be disbursed through selected incubators across India from 2021-25, the Department for Promotion of Industry and Internal Trade said in a notification. A committee will evaluate and select incubators for allotment of seed funds. A National Seed Fund was first announced in Union Budget 2020-21 to support ideation and development of early-stage startups.

T&C Apply: The eligible startups should not have received more than Rs 10 lakh of monetary support under any other central or state government scheme. However, this does not include prize money from competitions and grand challenges, subsidised working space, founder monthly allowance, access to labs, or access to prototyping facilities. Another condition for eligibility is that shareholding by Indian promoters in the startup should be at least 51% at the time of application to the incubator for the scheme.

As for the eligibility criterion for incubators, they must be legal entities, be operational for at least two years on the date of application to the scheme, have facilities to seat at least 25 individuals and have at least five startups undergoing incubation physically. The incubators must also have a full-time chief executive officer.

4. ETtech Done Deals

â– Trading platform Robinhood Markets is raising more than $ 1 billion from existing investors, having been strained by high volumes of trading this week, The New York Times reported.

â– Ula, an e-commerce marketplace for small retailers in Indonesia, has landed $ 20 million in Series A funding, led by Quona Capital and B Capital Group, with participation from existing investors Lightspeed India and Sequoia Capital India.

â– Saveo Healthtech, a business-to-business ecommerce marketplace for pharmacies, has picked up $ 4 million in seed funding, co-led by Matrix Partners and RTP Global, and participation from Incubate Fund and India Quotient.

■Co-working and flexible office space provider Inspire Co-Spaces has bagged $ 4 million seed funding from angel investor Ashish Chandna. The funds will be utilised to support the start-up’s expansion and future plans.

5. For hire: ByteDance India employees

As ByteDance resorted to mass layoffs in India after it was permanently banned over security concerns, rival social media and short-video apps were flooded with resumes and job requests.

To the rescue: MX Player’s TakaTak, ShareChat, Trell, Chingari, Bolo Indya, Mitron and Roposo are among the many companies likely to hire some of the affected workers.

Why it matters: India was TikTok’s biggest international market before the ban. ByteDance had a large workforce of around 2,000 in the country. ET on Friday reported that the Chinese company is unlikely to go ahead with its plan to occupy office space in Mumbai’s Goregaon suburb as committed in July.