Shares of Disney rose as much as 5% in late-day trading Monday after California provided new guidance allowing amusement parks to reopen in the state on April 1.

The rally is set to add more than $ 15 billion to Disney’s market cap, bringing it to around $ 360 billion.

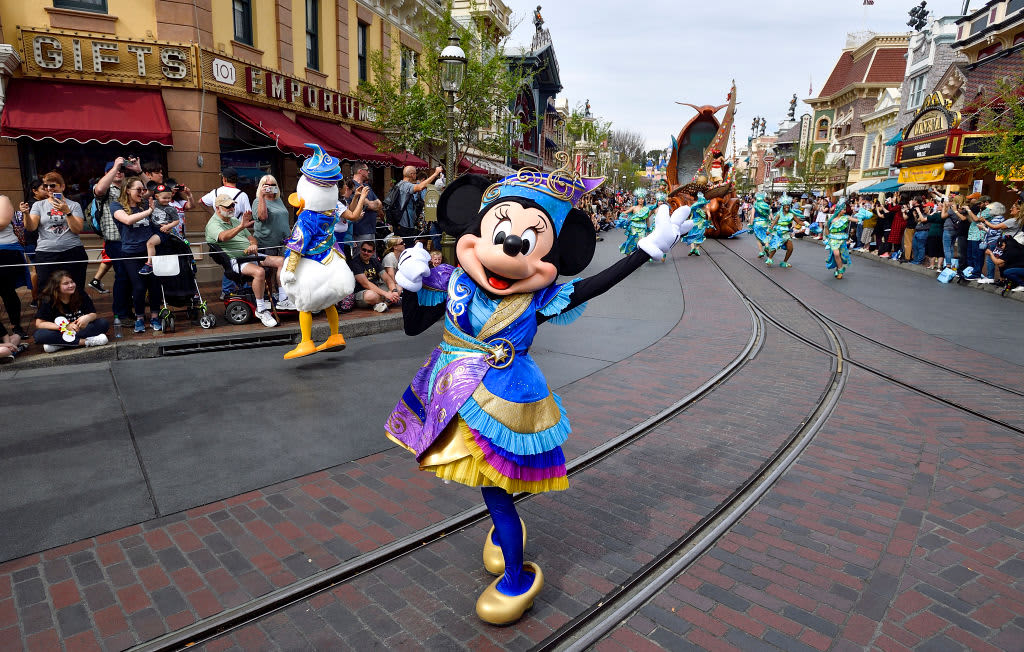

Disneyland and other parks in California have been closed for about a year due to coronavirus-related restrictions, even as other states, such as Florida, have allowed parks to reopen with limited capacity. Disney has not yet provided a reopening date for its California parks, but Disney and other theme park owners, including Universal Studios owner NBCUniversal, have pleaded with California officials to allow for a limited reopening.

The new state guidance permits amusement parks to reopen beginning April 1 with 15% to 35% capacity depending on the prevalence of the virus in the community. Masks and other health precautions will be required.

The shutdown led Disney to lay off tens of thousands of workers and slashed an important source of revenue for the media company. Disney said its parks and experiences sector saw a 53% dip in revenue in the December quarter compared with last year, at $ 3.58 billion. Disney said coronavirus-related closures cost the division about $ 2.6 billion in lost operating income for the quarter.

Officials are becoming more optimistic about a return to normalcy as more people become vaccinated against Covid-19. The Centers for Disease Control and Prevention said Monday that people who have been fully vaccinated can safely meet indoors without masks. While its California parks have remained closed to visitors, Disneyland recently began aiding the public health effort by serving as a vaccination site for state residents.

In addition to the theme park news, Disney could also stand to gain in its movie business. More theaters in North America have been opening up, with 45% of theatres in the region open over the past weekend, compared with 42% the weekend prior, according to Comscore.

The move came on a mixed day for markets, with many tech and social media companies falling while some traditional media companies rallied. For instance, ViacomCBS shares rose as much as 8%, and Discovery shares were up more than 2%.

Disclosure: NBCUniversal is the parent company of both Universal Studios and CNBC.

— CNBC’s Sarah Whitten contributed to this report.