By Rushabh Desai

Credit risk funds have always been vulnerable to its investments of up to 65% (and more) in the lower-rated instruments. To earn higher returns than the rest of the debt categories, the fund manager buys high-yielding, low credit quality bonds. The fund manager hopes the bonds would get an upgrade as it will increase the bond’s mark-to-market price value in the secondary market. He is also expecting that the issuer of these bonds will not default on their dues – both principal and interest pay-out. However, things have not clearly worked out well for most of the credit risk funds and their managers.

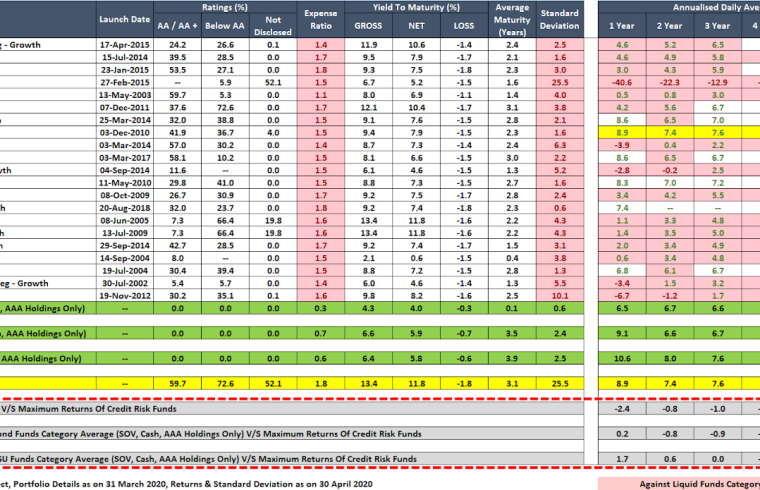

Forget about the extra returns, a large number of credit risk funds have underperformed the category average of liquid funds, considered one of the safest in the debt mutual fund category. Also, these funds had their portfolios in high quality instruments. The most important thing to note is that the maximum returns in the credit risk category was barely 1-2% more than the category average of high-quality liquid funds. The average returns of other categories like corporate bond funds and banking & PSU funds with high quality instruments have either outperformed or underperformed marginally the maximum returns of the high yielding credit risk funds.

Why you should stay away

Downgrade/default risk

High downgrades and defaults risks have been one of the major reasons for the massacre of the credit risk returns. As per CRISIL, the value of debt downgraded more than trebled to around Rs. 1.38 lakh crores in the first half of fiscal 2020 from around Rs. 39,000 crores in the first half of fiscal 2019, that’s the highest for any half since fiscal 2016. CRISIL’s downgrades (469) outnumbered upgrades (360) in the second half of fiscal 2020 with ICRA seeing twice as many downgrades as upgrades as well.

Liquidity risk

Liquidity has always been a problem for low credit quality debt instruments. Mostly no one wants to take credit risk of high volumes in their books. In the current risk-averse scenario, it is amplified. Due to downgrades and heavy redemptions, the credit risk category AUM shrunk from around Rs. 81,000 crores in March 2019 to around Rs. 55,000 crores in March 2020. To meet the redemption pressure caused by the COVID-19 pandemic, many fund managers were forced to borrow and/or sell high credit quality instruments. This tremendously pulled down the funds’ NAV. The recent Franklin fiasco of shutting down its schemes happened mainly due to the illiquid nature of the low credit quality instruments in their portfolios as the AMC couldn’t deal with the heavy panic redemptions.

High expense ratio

Credit risk funds have the highest expense ratios amongst all of its peers in the entire debt category. The high expense in the name of premium is paid to credit expert fund managers and to distributors as incentives to sell these so-called high yielding products. Over the years these high expenses ratios have taken away a good portion of the returns. This just doesn’t make sense when the category is posting poor returns.

Finally, the overall performance of the credit risk category has been very poor. The so-called high-yielding credit risk funds are not high yielding after all. Also, the category must prove its mettle, especially during testing time like these. Until then, the category will only burn holes in investors pockets and fill the pockets of advisors and AMCs promoting it. The high YTMs (Yield-to-Maturity) remains only on paper, it does not benefit the investor in reality.

Due to COVID-19 pandemic, CRISIL has predicted 800 plus non-oil & non-BFSI listed Indian companies are likely to see around 10% slide in revenue growth, the worst in at least a decade for FY 2021. This may further intensify the hit in the credit risk space. Thus, one should not invest in any credit risk funds and stay away from them. That is the wise thing to do now.

(Rushabh Desai is an AMFI registered mutual fund distributor based in Mumbai.)