Firms that do business overseas have been breathing sighs of relief as the U.S. dollar trends lower, but Jim Cramer’s charts suggest that the decline may not last.

To find out more about the currency’s movements, the “Mad Money” host turned to the charts of Carolyn Boroden, the technician behind FibonacciQueen.com and Cramer’s colleague at RealMoney.com.

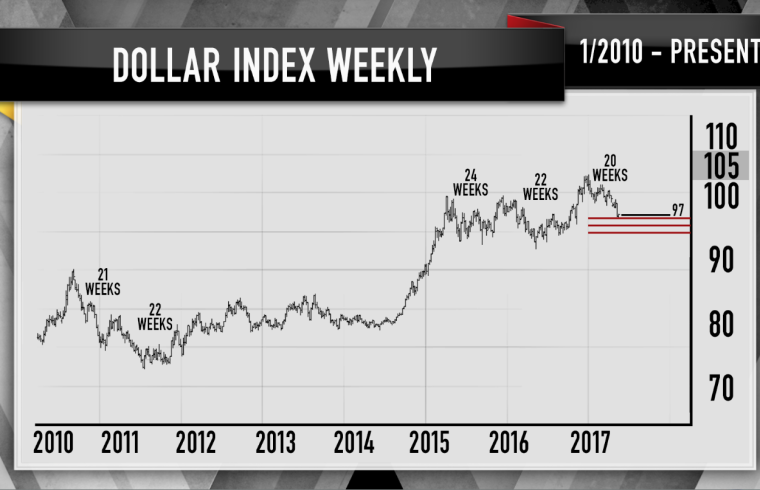

First, Cramer examined the weekly chart of the U.S. Dollar Index, which measures the greenback’s value against other foreign currencies.

Boroden noticed that the dollar index has been hitting higher highs and higher lows for some time, a sign that the dollar could be gearing up for a rally if it holds those lows.

“Perhaps more important, Boroden sees three major floors of support for the dollar index, all of which run from 95 to 96 and change. Given that it’s currently at 97, there’s no question that these support levels are indeed holding,” Cramer said. “As much as we might want a weaker dollar, the charts seem to suggest that it is not in the cards.”

Beyond that, Boroden thinks the dollar could even be due for a bottom based on the length of its past moves.

The currency’s latest downtrend lasted for 20 weeks since the peak, she noted — very similar to its past four declines, which ranged from 21 weeks to 24.

“It may sound really glib to say, ‘Hey the dollar index just dropped for 22 weeks last time around, so now that we’re 20 weeks into this decline it’s probably ready for a rebound.’ But that analysis would’ve actually worked the last four times!” the “Mad Money” host said.

To further cement her point, Boroden used her signature method, running Fibonacci ratios, to determine if the dollar index’s decline is really ready to turn into a rally.

The “Fibonacci Queen” spotted a number of cycles that come to pass around the first week of June, yet another sign that the dollar’s pullback could be ending soon.

“In fact, she says it’s entirely possible that the dollar index already bottomed last week,” Cramer said. “So if this long-term uptrend in the greenback remains intact, she wouldn’t be surprised if the dollar index … can go from 97, where it is now, to 105, which would be a pretty substantial move for a currency even if it doesn’t sound like very much.”

Overall, Boroden’s analysis suggests that the next few weeks could bring back the dollar’s tailwinds, in turn putting pressure on companies with international operations, because a strong dollar means overseas earnings are converted into fewer dollars for U.S.-based players.

“As much as I like to focus on the fundamentals of individual companies, the truth is that big-picture issues like currency do matter to the stock market,” Cramer said. “If you thought the terrible, horrible, super-freaking-strong dollar had finally gone away, the charts, as interpreted by Carolyn Boroden, say ‘Not so fast.’ She thinks the dollar’s decline is running out of gas, and it will soon resume its long march higher. Perhaps it bottomed already.”

Watch the full segment here:

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram – Vine

Questions, comments, suggestions for the “Mad Money” website? [email protected]