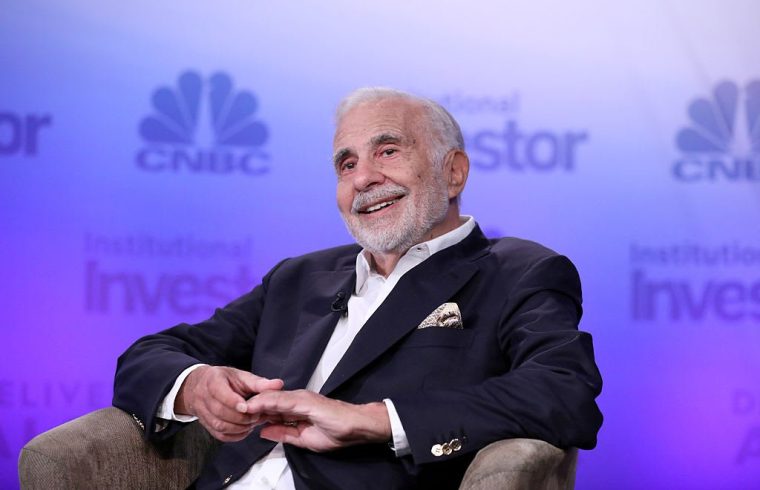

Carl Icahn at the 6th annual CNBC Institutional Investor Delivering Alpha Conference on September 13, 2016.

Heidi Gutman | CNBC

Carl Icahn knows the oil and gas industry very well and has arguably made more of his fortune in this industry than any other single industry. His next energy bet could pay off through a takeover or a rebound in oil prices.

Company: Delek US Holdings (DK)

Business: The company engages in the integrated downstream energy business in the United States. The company operates in three segments: refining, logistics, and retail.

Stock Market Value: $ 1.5 billion ($ 20.51 per share)

Activist: Carl Icahn

Percentage Ownership: 14.86%

Average Cost: $ 13.09 per share

Activist Commentary: Carl Icahn has extensive experience in successful investing in the energy sector. He has had recent activist campaigns at Sandridge, Energen and Occidental Petroleum and had previously ousted Michael Talbert, the chairman of Transocean Ltd., the world’s largest drilling contractor, when one of Icahn’s employees was given a board seat by shareholders. Prior to that, another Icahn employee received a board seat at oil and gas company Chesapeake Energy Corp. leading to the ouster of its chairman/CEO Aubrey McClendon. Also in 2012, he spent $ 2.6 billion to acquire 80% of oil and gas refiner CVR Energy. However, his experience in this industry goes back much further. Icahn acquired National Energy Group, TransTexas Gas and Panaco in 2005 for $ 625 million, cleaned them up and sold them seventeen months later for $ 1.6 billion.

What’s happening:

Icahn believes that the Company could be a synergistic acquisition opportunity for CVR Energy’s petroleum segment that he owns and intends to seek to have discussions with the company regarding potential transactions involving the company and CVR Energy.

Behind the scenes:

While many of Icahn’s energy investments have not done so well as the price of oil imploded, the investor often hedges out the oil risk so his returns on these investments may not be what they appear to be.

Icahn is universally considered to be one of the best investors and shareholder activists. He has made billions of dollars for shareholders from his activist campaigns. However, he is also an investor and not everything he does is activism. Moreover, just because he files a 13D, it does not make it an activist situation.

This is a situation of Icahn acting as an investor, and not as a shareholder activist. He is openly trying to buy the company, so his interests are somewhat counter to other shareholders not aligned with them. There is nothing wrong with that, but this situation should not be confused with the many campaigns he launches on behalf of shareholders. While he is interested in buying the company at the best price, that does not mean that any deal would not be fair to shareholders. If the board and other large shareholders do their jobs right and ultimately decide to sell to Icahn, this could be good for everyone.

Icahn has a history of being transparent in these situations and going the extra mile to be fair to shareholders. When he acquired CVR Energy, to assuage shareholder concerns that he was just going to flip it, he offered CVR’s existing shareholders $ 30 a share, plus a “contingent cash payment agreement,” which gave shareholders the right to any amount over $ 30 a share if Icahn flipped CVR to another buyer within nine months.

At the Ira Sohn conference that year, John Paulson commented on the structure, saying “CVR Energy is a gift from Carl Icahn. Carl is generally particularly friendly to shareholders.”

Icahn is also one of the best cyclical investors in history and may also be viewing this as an opportunity to buy good assets at a great part of the cycle. He acquired his position in March of this year when oil was close to its historical lows, and he got in for an average price of $ 13.09 per share.

With the stock now at $ 23.34 per share, Icahn’s interest in acquiring the company could be waning; and this could end up being just another well-timed, successful investment for Icahn.

Ken Squire is the founder and president of 13D Monitor, an institutional research service on shareholder activism, and the founder and portfolio Manager of the 13D Activist Fund, a mutual fund that invests in a portfolio of activist 13D investments.