Geojit has given a buy rating to PNC Infratech with a 12-month target price of Rs 182. The share price moved up by 4.79 per cent from its previous close of Rs 149.15. The stock’s last traded price is Rs 156.30.

Revenue grew by 8 per cent YoY despite 10 days of execution impact due to lockdown in Q4FY20. EBITDA margins declined by 55bps to 13.5 per cent due to higher raw material and employee cost. Adjusted PAT growth was moderate at 3 per cent year on year to Rs 76 crore due to increase in depreciation and interest costs.

Investment Rationale

According to the brokerage, EBITDA margins declined by 55bps year to year at 13.5 per cent due to increase in raw material cost (12 per cent) and employee cost (15 per cent year on year), which partially offset by 14 per cent year on year fall in other expenses. Further higher depreciation (15 per cent year on year) & interest cost (63 per cent year on year) impacted earnings growth which grew by 3 per cent year on year to Rs 76 crore. Interest cost was increased to Rs 32 crore mainly on account of interest cost on mobilization advances of Rs 14 crore.

The strong order book of PNC is providing revenue visibility for coming years. The brokerage expects execution to pick up from the second half of FY21 as most of the HAM projects are under execution stage. Due to near term hindrance on execution, the brokerage has reduced revenue estimate for FY21E/FY22E by 24 per cent/14 per cent respectively. It values EPC business at a P/E of 9 times on FY22E EPS & BOT/HAM projects at 0.5 times P/B and has revised the rating to buy.

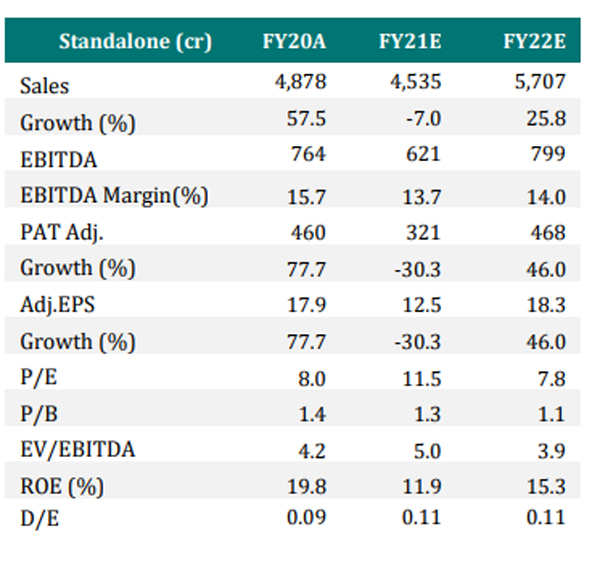

Source: Geojit

Financials

For the quarter ended March 31, 2020, the company reported consolidated sales of Rs 1346.70 crore, down -3.14 per cent from last quarter sales of Rs 1390.41 crore and up 6.00 per cent from last year’s same quarter sales of Rs 1270.42 crore. The company reported net profit after tax of Rs 88.82 crore in the latest quarter.

Promoter/FII Holdings

Promoters held 56.07 per cent stake in the company as of March 31, 2020, while FIIs held 6.37 per cent, DIIs 23.81 per cent and public & others 13.75 per cent.