By Nupur Acharya

Bharti Airtel Ltd. may see its stock value rise 50%-100% over the next three years on a revenue boom in India’s telecommunications sector, according to Jefferies India Pvt.

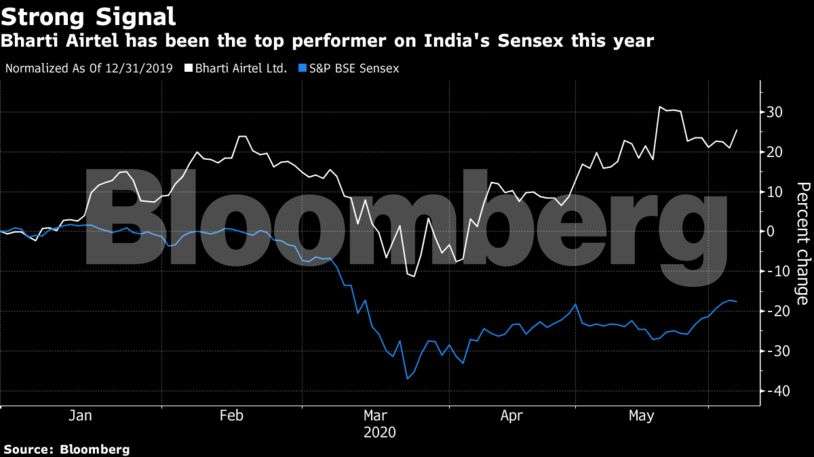

Bharti Airtel is this year’s top performer on the benchmark S&P BSE Sensex, with a gain of 26%. Of the 30 analysts covering the stock, 28 have a buy rating, even after the company lost its position as the nation’s largest wireless carrier to Mukesh Ambani’s Reliance Jio Infocomm Ltd. last year.

“With the market being a virtual duopoly, competition is at the lowest it has ever been,†and that should help sector revenue double over the next five years to $ 38 billion, analysts Akshat Agarwal and Pratik Chaudhuri wrote in a note dated Tuesday.

Bloomberg

Jio’s entry in 2016 shook up the industry with free calls and cheap data plans, forcing some companies to merge and others to drop out. Amid this consolidation, India’s telecom market has drawn attention from global giants, with Reuters reporting Amazon.com Inc. is in preliminary talks to buy a stake in Bharti Airtel of at least $ 2 billion. Facebook Inc. and others are backing Reliance Jio. Even struggling No. 3 carrier Vodafone Idea Ltd. has reportedly drawn interest from Alphabet Inc.’s Google.

Airtel in an exchange filing Friday said it “routinely works†with all digital and OTT firms but isn’t considering any proposal to sell a stake to Amazon at this stage.

India’s ratio of mobile revenue to gross domestic product is among the lowest of countries with similar per capita GDP, suggesting scope for average revenue per user to rise, Jefferies said. The analysts noted that countries with relatively low competition have higher mobile revenue to GDP.

Bharti Airtel and Jio added 24 million gross users in the March quarter after an increase in tariffs in December, indicating, the market is willing to accept higher costs, the analysts wrote.

Jefferies maintained its buy rating on Bharti Airtel and 12-month price target of 660 rupees per share. It said the company’s “fair value†could reach 840 to 1,110 rupees per share by March 2023 as industry revenue expands.