BENGALURU: A large number of taxi drivers have quit Ola and Uber and not many new ones are signing up, but that might be a good thing.

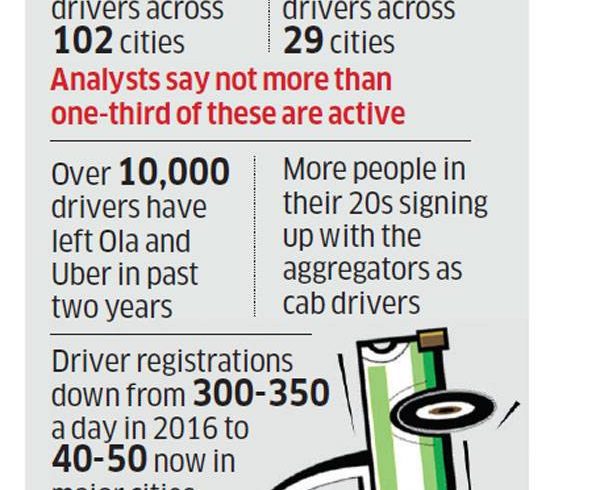

Analysts and company executives ET spoke with said more than 10,000 drivers have left Ola and Uber in Bengaluru alone in the past two years, as the companies gradually lowered the heady incentives they used to lure the drivers. Also, driver registrations have plunged from 300-350 a day in 2016 to 40-50 this year across Bengaluru, Mumbai and Delhi.

Even so, the analysts said, the slowing growth in the fleet sizes is emblematic of a market that is maturing and stabilising after nearly a half decade of frenzied growth that was beginning to affect operations.

“While the supply (of drivers and vehicles) has dropped from 2016 to 2017, it is stabilising and the market is slowly showing signs of maturing,” said Jaspal Singh, partner at Valoriser Consultants.

“Newer drivers coming on board are aware that the incentives and salaries offered are lower than what they were last year. They are more prepared to work longer hours for lower wages in the pursuit of owning a car in the long run.”

Many of the drivers who have dropped off the platforms were earning Rs 60,000 to Rs 1 lakh a month in fares and incentives, he said.

Ola and Uber did not immediately reply to emailed queries from ET.

Currently, Ola has about 550,000 drivers on its platform across 102 cities and Uber India about 400,000 drivers in 29 cities, according to the companies. Analysts, however, estimate that not more than one-third of these drivers are likely to be active.

Ravi Shah, a Delhi-based driver, said he returned to his previous job as a personal driver after plying for Ola and Uber for about one-and-a-half years. “It was too much of a burden. I prefer working for a family as a full-time driver, getting meals and a weekly day off. I still earn more than Rs 15,000 a month, plus festival bonuses, while enjoying a much better quality of life,” said Shah.

Several of his friends, he said, have returned to working with other taxi companies, independent outdoor rental services, or as full-time domestic drivers.

For Ola and Uber, though, demand continues to increase as customers remain hooked to the ease of tapping their mobile phones to haul a cab. This, even though fares have increased by at least 15-20% across cities, said an analyst, unwilling to be identified.

The taxi aggregators “are experimenting with different prices in different cities to see what the consumer is willing to pay. This is something that would happen independently of supply”, said this analyst. “The focus is on profitability.”

An Ola executive, speaking on condition of anonymity, said the driver exits and fewer registrations have not had much impact on the company.

“Now the market is maturing. The drivers who are likely to stick are often younger drivers who were working at even more unsatisfying jobs and are willing to put in the additional amount of time so they can be independent car owners after working four-five years with Ola, Uber or both,” this executive said.

Ram Vikas, a 24-year-old driver with Uber, was earlier a delivery boy for an ecommerce company. He says he switched to driving a taxi with the hope of owning a car by his late 20s. “I was earning around Rs 20,000 a month as a delivery boy. With Uber, even though the hours are long, I will get to own a car in a few years,” said Vikas. “That will make my parents in the village proud and I can start saving money after that.”