1. U.K. election jitters: The British pound was under pressure Wednesday after a new election projection showed that Prime Minister Theresa May could lose her majority in parliament.

Investors had been counting on a big win for May in the June 8 election, but the YouGov projection suggests that her party could lose a sizable number of seats. The result might be political gridlock.

Kallum Pickering, an economist at Berenberg Bank, said that unreliable polling data and an uncertain political landscape make the election result especially difficult to predict.

“To put it one way, we would not be very surprised if there was surprise!” he said.

The pound was trading 0.5% lower on Wednesday at just below $ 1.28. The currency has fallen 14% since the day of the Brexit referendum.

2. ExxonMobil meeting:Exxon(XOM) will hold its annual shareholder meeting on Wednesday, and climate change will top the agenda.

The event will feature a vote on a proposal that requires for Exxon to stress test its assets for risks posed by curbs on carbon emissions and new technology like electric cars.

The vote is seen as ground zero for efforts to get fossil fuel companies to acknowledge the ground is shifting beneath them.

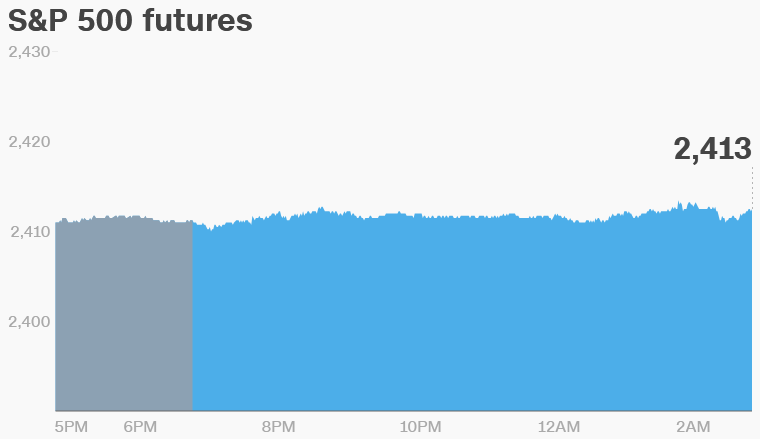

3. Global market overview:U.S. stock futures were flat early on Wednesday.

European markets were mixed in early trading. Asian markets ended the session mixed.

The Dow Jones industrial average shed 0.2% on Tuesday, while the S&P 500 and Nasdaq declined 0.1%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Earnings and economics: Fashion retailers Michael Kors(KORS) and Vera Bradley(VRA) are set to release earnings before the open, while Hewlett Packard Enterprise(HPE, Tech30) will follow after the close.

Investors will get closer look at the U.S. housing market on Wednesday. Data on mortgage applications will be released at 7 a.m. ET, with a home sales report following at 10:00 a.m.

Download CNN MoneyStream for up-to-the-minute market data and news

America’s closest neighbors will also publish reports on their economies. Canada’s GDP data is expected at 8:30 a.m. At 1:30 p.m., Mexico’s central bank will release its inflation report.

India will release its first quarter GDP growth data at 8 a.m. on Wednesday. Economists believe India’s economy maintained its impressive 7% GDP growth pace, keeping it atop the list of the world’s fastest growing major economies.

Chinese manufacturing data showed a slight rebound in May.

5. Coming this week:

Wednesday – ExxonMobil(XOM) shareholders meeting; Michael Kors(KORS) and Vera Bradley(VRA) earnings; U.S. housing mortgage applications and home sales data; Canadian GDP report; Chinese manufacturing data

Thursday – Lululemon(LULU) and Express(EXPR) earnings; U.S. crude inventories; Institute for Supply Management manufacturing index;

Friday – Jobs report