“One noon during a break in the rains, there was a cool soft breeze blowing; the smell of the damp grass and leaves in the hot sun felt like warm breathing of the tired earth on one’s body…the postmaster had nothing to do…†– Tagore in The Postmaster.

The peace and tranquil of the postmaster as captured by Rabindranath Tagore more than a century ago may be coming to an end as the ubiquitous postman adds ATM machines and mutual fund investments to the dwindling postcards and inland letters in his brown shoulder bag.

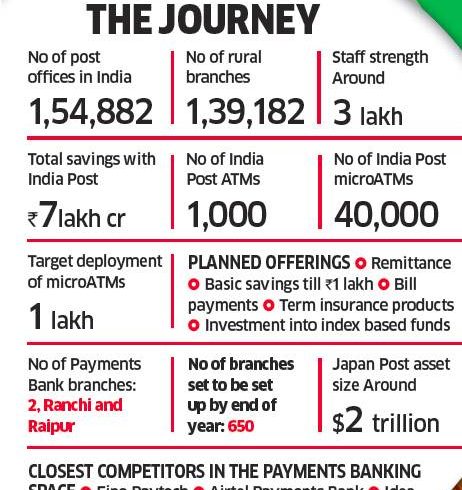

India Post, which has almost become extinct to a generation of people in urban India, prepares for a new life under the India Post Payments Bank by marrying its almost 1.5 lakh physical branches, of which 89% are in rural areas, and 3 lakh employees with the latest technology available to reach out to villages which even the politicians visit only during elections. A postmaster, or a postman, is not new to handling other people’s money, but the recent past saw the institution taking a back seat. Not long away, it used to be the only mechanism for thousands of villagers to receive funds from bread winners from far off places through money orders – an instrument that India Post suspended few years back.

This year would see the postal bank expand its operations through 650 branches at district headquarters across the country, where it would provide services like remittances, bill payments, etc. A pilot project is underway in Ranchi and Raipur. It aims to fulfil the needs of millions of people in regions where nationalised banks failed and private sector largely ignored them.

“I will provide payments infrastructure in the nature of public good,†says Ashok Pal Singh, chief executive officer, India Post Payments Bank. “What is this? It is a payments platform. The post office has built a physical network and now that is getting connected. I want to look at the network as a platform —both as a virtual platform as well as a physical platform.â€

Banks have been reluctant to come to villages because it would be a loss-making venture given their infrastructure costs and the need to have feet-on-street. As far as the postal department is concerned, it has the infrastructure, personnel and the most needed element in banking—trust.

“They already have trust factor on their side, they have phenomenal access,†says Naresh Makhijani, partner and headfinancial services, KPMG India. “Also there has been a large scale adoption of technology in the postal department coupled with the government’s Digital India initiative. All these factors should be positive ingredients.â€

India Post traces its history back to 1858 when India’s administration was transferred to the British Crown from the East India Company. The legendary institution started its savings bank business in 1873 and began insurance activities in 1884. It also has the distinction of carrying the first airmail delivery in the world. Despite its head start more than a century ago, it had fallen on bad times due to years of neglect by the government and its inability to cope with developments such as private couriers and lack of interest in lobbying for widening of its role as an institution beyond accepting savings. But the tide appears to be turning with it getting the payments bank licence and Prime Minister Narendra Modi’s special attention to carry his financial inclusion agenda.

“For India Post, it has already been in the business of taking deposits, even basic banking,†says Vivek Belgavi, fintech leader, PwC. “They can do deposit withdrawal through their PoS terminals. They can add a lot more through their huge reach.†But making India Post deliver on financial services may be like turning a giant ship. Physical reach may be a given, but figuring out what the customer wants, the technology and training its own men could be big challenges. Furthermore, banks themselves have woken up to the potential. They are widening their reach through tieups with fintech companies.

Payments banks like Bharti Airtel, or Reliance-SBI joint venture may be able to reach customers more quickly as they do not have legacy issues. But India Post is positioning itself more as an aggregator rather than as a competitor to gain market share. “While the other players in this space have their own financial goals to be met, I am saying that I will serve them as well,†says India Post’s Singh who has worked with UIDAI on the Aadhaar programme too. “If an Airtel Payments Bank customer wants to withdraw his deposit, my postman will get it done,†says Singh. “Even a Mobikwik wallet can use our networks and not suffocate within a closed loop.â€

To start with, the India Post Bank has got the basic right – technology. And it would keep its costs so low that most banks would not even attempt to compete with it, or they would also be forced to give up their ways of milking customers with hidden costs.

It is developing an open source nonproprietary platform, which makes transactions cheaper eliminating the entire debate around digital payments being more expensive than cash. Aided by cheap Aadhaar-based payments, biometric authentication, leveraging of the UIDAI platform, India Post says it can authenticate and settle transactions for as low as 5 paise when big banks are demanding Rs 15 per ATM transaction. “For UIDAI, the cost of each authentication is around 0.1 paisa and this is because it is an open platform, not licence based and is modular and scalable, we will do something very similar,†says Singh.

THE JAPAN POST WAY

While there are skeptics about what India Post could do to unbanked masses, there are examples like the Japan Post and Japan Post Insurance, which have become the supermarket for citizens’ financial needs. Japan Post manages close to $ 2 trillion of assets and is among the top generator of savings funds.

But for India Post to grow like its Japanese peer, the regulator should provide it with a full fledged banking licence where it not only takes deposits, but also lend. Of course, India Post which has deposits of Rs 7 lakh crore, second only to State Bank of India, needs to enhance the skills of its staff and it may be years before that happens. The faltering of state-run banks in the past decade does not inspire confidence in a government-owned institution being prudent with money.

“The government has not been entirely successful in driving financial inclusion through the public sector banks, hence that will be a huge challenge,†says Makhijani of KPMG. “This is like a transformation from the days of the money order to the digital, it will be interesting to note how the switch happens.†Even for Japan Post, diversifying of asset ownership happened in recent years before which it was just buying the Japanese government bonds. Now, it even invests in hedge funds to boost returns. “Eventually, they will become a full service commercial bank,†says Bhavik Hathi, MDtransaction advisory group, Alvarez & Marsal, a financial consultancy.

“A payments bank licence is a good practice ground for them. They get to know their customers better, people will also get used to dealing with them for financial products. They can start off with micro loans, small insurance products, etc. The natural progression should be to become a full fledged bank.†The baby step has been taken, but it may be a long wait for the giant leap.