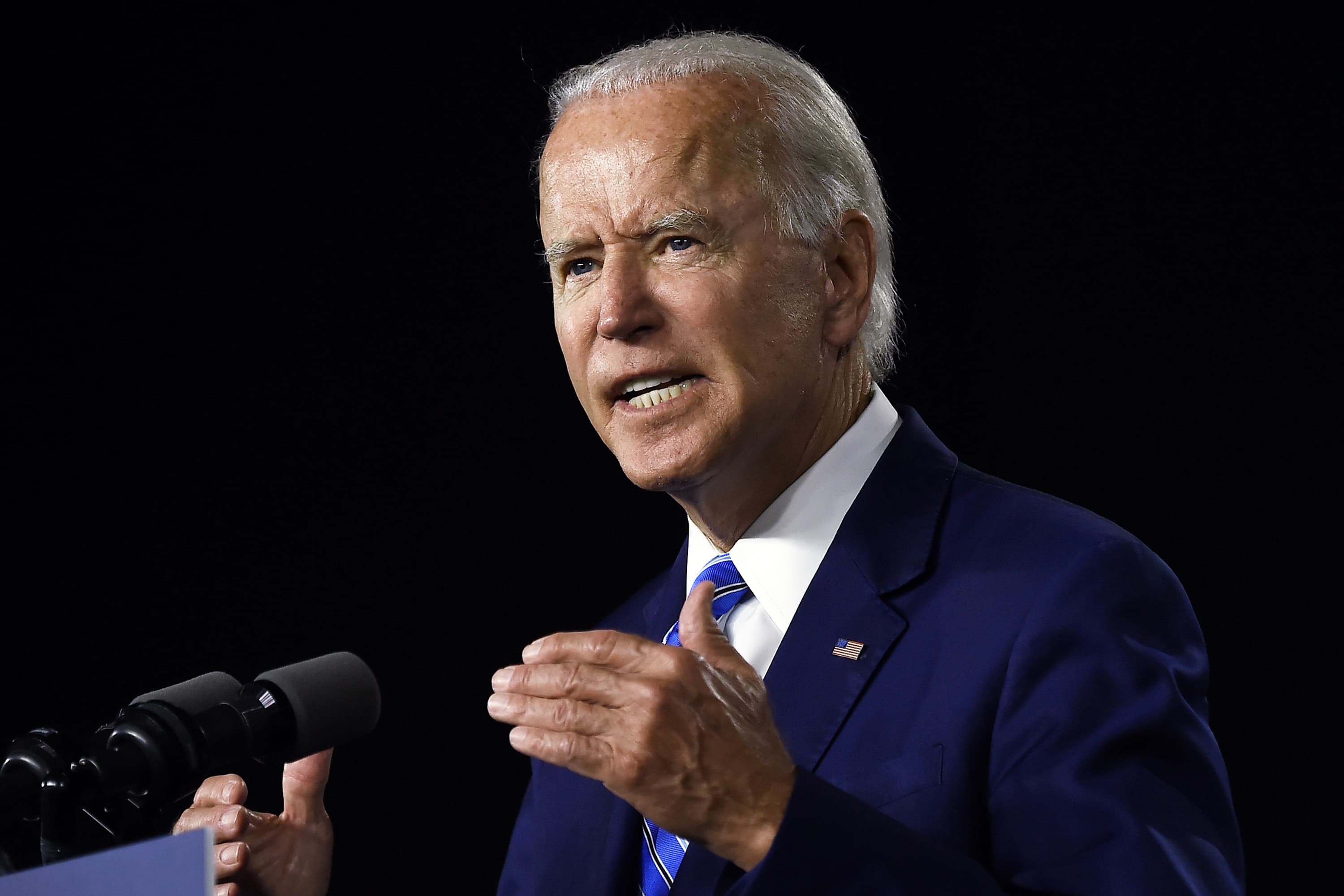

Democratic presidential candidate and former Vice President Joe Biden speaks at a “Build Back Better” Clean Energy event on July 14, 2020 at the Chase Center in Wilmington, Delaware.

Olivier Douliery | AFP | Getty Images

An overhaul of your tax planning could be around the corner if former Vice President Joe Biden wins the 2020 presidential election.

The Democratic presidential contender teamed up with Sen. Bernie Sanders, I-Vt., and the two formed six task forces to release a 110-page policy document earlier this month.

The plan gives Americans a sense of what they can expect if Biden wins the presidential race in November.

More from Personal Finance:

Unemployment crisis hits big cities hard

Will there be a second $ 1,200 stimulus check?

Government relief is coming to an abrupt end

“Use taxes as a tool to address extreme concentrations of income and wealth inequality,” the task force wrote in their policy plan.

“A guiding principle across our tax agenda is that the wealthiest Americans can shoulder more of the tax burden, including in particular by making investors pay the same tax rates as workers and bringing an end to expensive and unproductive tax loopholes.”

Democrats would need to retain the House, capture the Senate and take the White House — a trifecta — in order to see those plans to fruition, said Hank Gutman, who is of counsel at Ivins Phillips Barker in Washington, D.C.

“If you get a trifecta, rates are going up on individuals,” Gutman said. “Income tax rates will go up.

“If there isn’t an elimination of the preferential treatment of capital gains, there will be a reduction of it targeted toward high-income individuals,” he added.

Gutman discussed what could be ahead in a Biden presidency during the American Institute of CPAs’ annual ENGAGE conference on Monday.

Tick-up on individuals

Biden’s tax proposals from earlier this year called for raising levies on taxpayers with incomes exceeding $ 400,000.

In particular, he would do away with the current top ordinary income tax rate of 37%, raising it to 39.6%, according to an analysis from the Tax Policy Center.

Taxpayers with earnings in excess of $ 400,000 would also be subject to the Social Security payroll tax, according to the analysis. Currently, wages up to $ 137,700 are subject to the Social Security tax, of which the employee’s share is 6.2%.

Rates on capital gains would also go up.

Currently, the long-term capital gains tax rate is 20% for single households with more than $ 441,451 in taxable income ($ 496,601 for married-filing-jointly) in 2020.

Biden has proposed subjecting capital gains to the same rates as ordinary income for households earning more than $ 1 million. In this case, they would face a levy of 39.6%.

“He’s thinking of taxes much more as a pay-for, a source of revenue to pay for spending initiatives,” said Howard Gleckman, senior fellow at the Urban-Brookings Tax Policy Center. “He has tax credits for this and that, but they’re relatively modest.”

Changes to wealth transfer

freemixer | E+ | Getty Images

The Tax Cuts and Jobs Act roughly doubled the amount that you can transfer to others — at your death or during your life as a gift — without being subject to the 40% estate and gift tax.

The so-called estate and gift tax exemption is $ 11.58 million per individual in 2020.

What wealthy investors should watch out for is a change to a tax code provision known as the “step-up in basis.”

This provision allows an individual to hold an asset for years, capture appreciation over time and then bequeath it to an heir at death. The owner’s original investment in this asset — the basis — rises or “steps up” to the market value at death.

The heir receives this “stepped up basis,” and can sell the asset with little to no capital gains tax.

Biden has effectively proposed putting the kibosh on this tactic.

Instead, the unrealized capital gains within the asset would be subject to tax at death, according to the Tax Policy Center’s analysis.

In that manner, the heir gets hit with the tax upon transfer — regardless of whether he sells the asset.

Cautious preparation

As dramatic as these proposals may seem, wealthy investors are watching and waiting.

Remember, Democrats still have to capture the White House and the Senate, as well as maintain their hold on the House for these proposals to move.

One thing high-net-worth people are thinking about is how they can get assets out of their estate before the laws are overhauled.

“The game would be to transfer the appreciated assets to a trust or to the kids before the rules change,” Gutman said.

“Once you know the election results, you can start doing some serious thinking,” he said. “If there’s a trifecta, do some contingent planning, but not necessarily execution.”