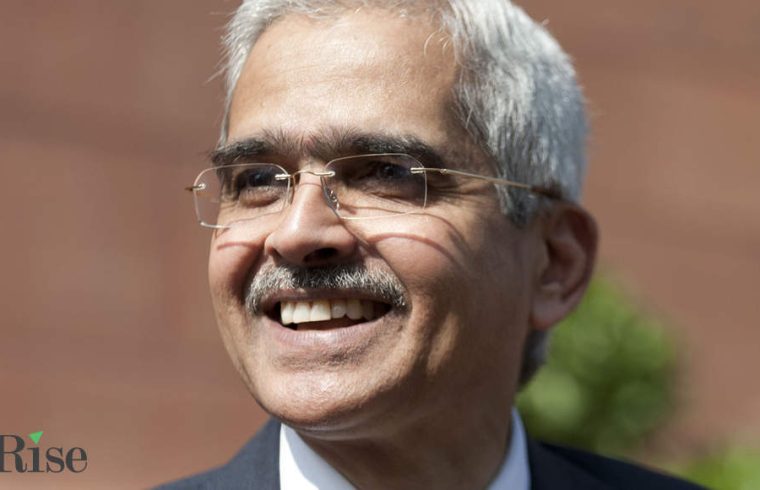

Mumbai: Reserve Bank of India governor Shaktikanta Das has raised concerns over demand sustainability with the close of the festive season and rise in Covid-19 infections in India which pose downside risks to growth. Speaking at the 4th Foreign Exchange Dealer’s Association Annual Day, Das said on Thursday that despite the challenges posed by the pandemic, the regulator has worked in tandem with financial market participants to keep the system less volatile.

“We need to be watchful about the sustainability of demand after festivals and a possible reassessment of market expectations surrounding the vaccine,†Das said. “Even as the growth outlook has improved, downside risks to growth continue due to recent surge in infections in advanced economies and parts of India.â€

With nearly 45,000 fresh coronavirus cases and 92 lakh active infections some parts of India including the nation’s capital New Delhi, Rajasthan, Maharashtra and Karnataka have seen a fresh wave of cases.

After witnessing a sharp contraction in GDP by 23.9% in the first half of the current fiscal year and a multi-speed normalisation of activity, the Indian economy has exhibited stronger than expected pick up in momentum of recovery. But while economic activity indicators rose quickly over September and October, led by pent-up festival-led demand, they have moderated sharply since then.

“India will continue to approach capital account convertibility “as a process, rather than as an event” within a broad macroeconomic framework.”

Growth in electricity consumption, labour participation and e-way bills softened a shade as per a HSBC report which expects second quarter GDP to contract 7.9%. “The real test will likely come over the next few months when pent-up and festival-led demand abate,†the HSBC report said.

Automobile manufacturers have also expressed concern over inventory levels once the festive euphoria subsides.

“The sales of the last three months have barely been able to match last year’s, I’m worried about what will happen from December when festivals are over. A -3% growth is a matter of discomfort. We must see double-digit growth from January,”

Bajaj Auto, MD, Rajiv Bajaj said in an interview to a television channel.

A ET report has stated that after a record Diwali, demand for smartphones slumped 25% in November. Meanwhile, cash in the economy which is an indicator of sustainability of demand has gone back to banks post Diwali. After a decade high pre-festival increase in cash of over Rs 40,000 crore during the November 13 week, close to Rs 7000 crore of unspent cash has gone back to the banking system post Diwali in the week ended November 20.

The governor also assured the financial markets that the regulator will continue to work in a nimble-footed manner to ensure orderly functioning of the markets.

“The Reserve Bank remains committed to fostering orderly functioning of financial markets and will continue to evaluate incoming information having a bearing on the financial markets and act, as needed, to mitigate any downside risks,†he said.

Das also stressed that India’s capital account is now open to large extent.

“Today, the capital account is convertible to a great extent,†he said. “Inward FDI is allowed in most sectors and outbound FDI by Indian incorporated entities is allowed as a multiple of their net worth. The external commercial borrowing framework has also been significantly liberalised to include more eligible borrowers, even as maturity requirements have been reduced and end-use restrictions have been relaxed.â€