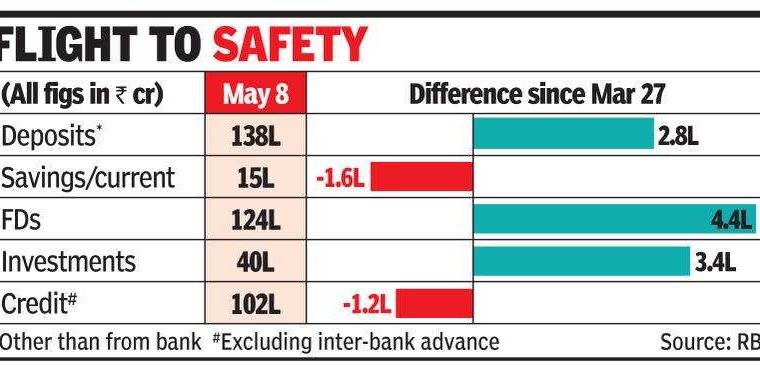

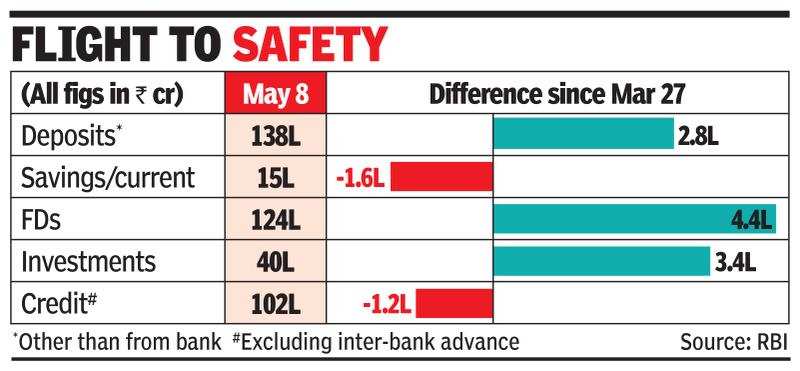

MUMBAI: Bank deposits have risen by over Rs 2.8 lakh crore in three fortnights of the lockdown till May 8, while bank credit during the period dipped by Rs 1.2 lakh crore, according to data released by the Reserve Bank of India. This has added nearly Rs 4 lakh crore to the liquidity in the banking system, resulting in a surge in investments by banks.

A few days into the lockdown, on March 27, bank deposits stood at Rs 135.7 lakh crore. A fortnight later on April 10, outstanding deposits surged to Rs 137.1 lakh crore. In another two fortnights, by May 8, the deposits rose to Rs 138.5 lakh crore — a rise of Rs 2.8 lakh crore in the six weeks since March 27. These three fortnights also saw bank credit decline from Rs 103.7 lakh crore on March 27 to Rs 102.5 lakh crore on May 8 — a drop of Rs 1.2 lakh crore in six weeks.

Banks have grown outstanding deposits by over 2% in six weeks, while the whole of FY20 (up to March 27) bank deposits had gone up by only 7.9%. The numbers indicate a big shift to bank deposits during the lockdown. Most of the money went into fixed deposits, where the outstanding amount rose to Rs 123.9 lakh crore on May 8 — an increase of Rs 4.4 lakh crore over March 27.

Current and savings deposit balances declined by Rs 1.6 lakh crore to Rs 14.6 lakh crore. While a decline in bank credit in April is not unusual, what accentuates this year’s decline is that the year-end surge in March, which leads to a pullback in April, was missing. As a result, FY20 credit growth was only 6.1% — less than half of the 13% growth in FY19.

Finance minister Nirmala Sitharaman, in her meeting with banks on Friday, will take up the progress of Covid-related credit and the extent of pre-approved loans that have been sanctioned. The FM has also called for details on the loan offers accepted and disbursement effected. The new schemes announced by the government under the Atma Nirbhar Bharat Scheme will also be discussed.

Last week, SBI chairman Rajnish Kumar had said that in April 2020, the public sector lender had seen a bank deposit growth of Rs 1.25 lakh crore, attributing it to a flight to safety. He added that credit growth was negative during April, leading to surplus liquidity in the banking system. Speaking to TOI, the SBI chairman said that top-rated corporates were raising funds from the money markets.

The amount outstanding under commercial papers jumped to Rs 4.17 lakh crore as on April 30, 2020, up from Rs 3.81 lakh crore as on April 15, with Rs 77,889 crore of paper being issued during the fortnight. Banks also say that small businesses are not availing of additional limits as they have been waiting for the loans that will be subsidised because of the government credit guarantee, which have recently been notified.

“People’s savings are shifting to banks since it is safe and people are not ready to spend, while trade, commerce and industry are withdrawing. The government must address the demand side by crediting cash to the affected sections of the society,†said Maharashtra State Bank Employees Federation general secretary Devidas Tuljapurkar.

He added that the government must strengthen banks by addressing issues such as recruitment as the heavy lifting in the form of credit to MSMEs, Mudra Shishu scheme, street vendors and Kisan credit cards have been shifted to banks. “In the process, the focus is being shifted from corporate credit to retail credit, in which involvement of the entire workforce is needed,†he said.