The U.S. economy will face great risk if lawmakers do not step up and stave off a looming, far-reaching eviction crisis, an economist with mortgage aggregator LendingTree told CNBC on Friday.

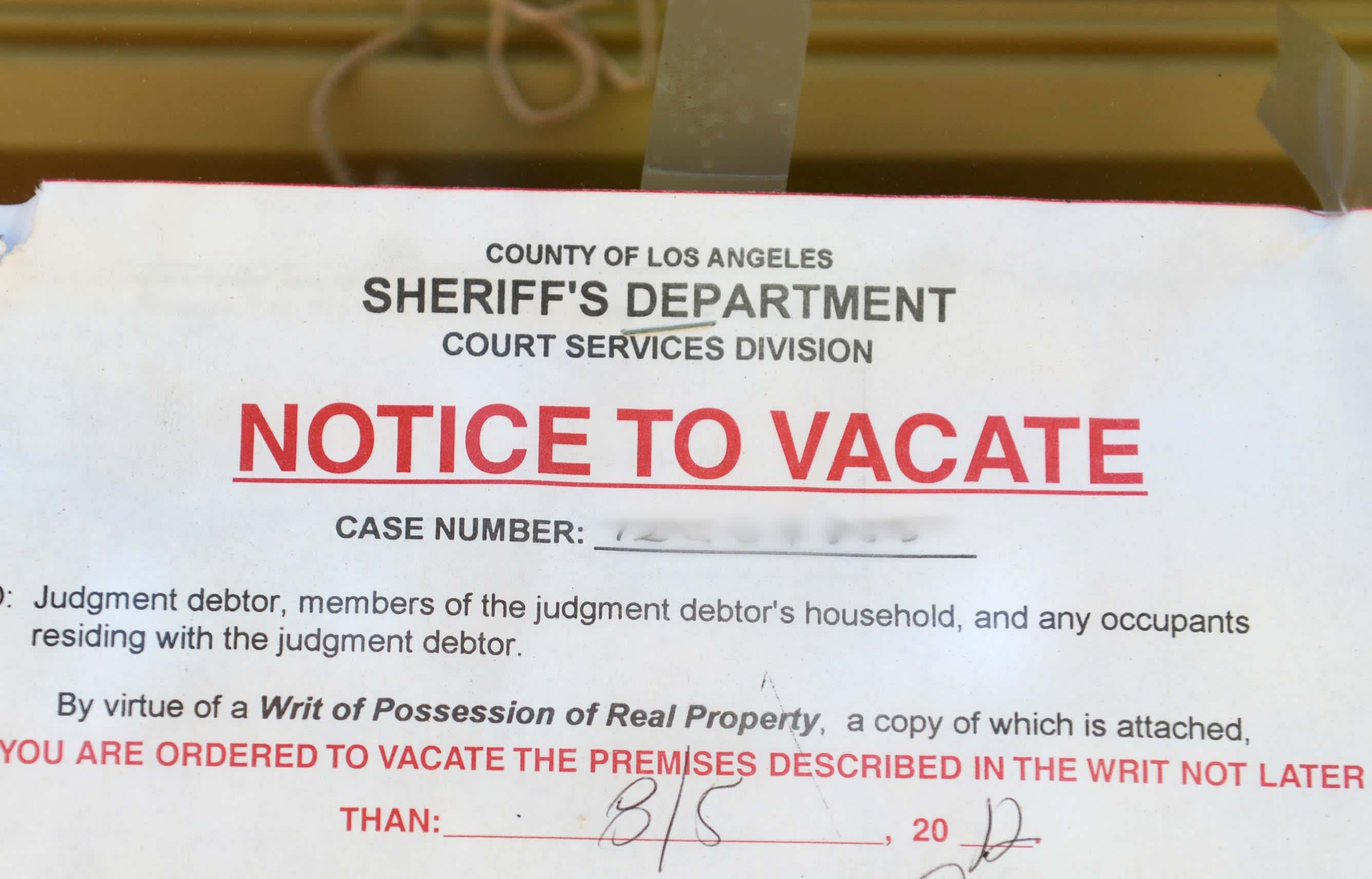

With eviction moratoriums lifting across the country, landlords could eventually default on mortgages and the coronavirus pandemic could worsen in the country if tens of millions of renters are put out of their homes in the midst of a tough economy, said Tendayi Kapfidze, chief economist at LendingTree.

“This really could be catastrophic, and it extends beyond just the rental industry,” he said in an interview on “The Exchange.” “It could actually affect the single-family housing market and the economy as a whole.”

Nearly 2-in-5 tenants across the country, particularly low-wage workers, are in danger of being served eviction notices, according to analysis from Stout Risius Ross, an investment consulting firm. People of color are especially vulnerable. While half of White renters project that they can cover rent, just more than a quarter of Black renters feel the same, according to the study.

Statewide holds on evictions have expired in more than 30 states and federal protections for renters, passed in March as part of the historic multitrillion-dollar CARES Act, have also lapsed. As unemployment continues to hover at extreme levels, as many as 40 million Americans are thought to be at risk of losing their homes in the middle of the global health crisis. That figure is four times greater than during the Great Recession.

The imminent eviction wave could morph into a financial crisis, bleeding into other industries, Kapfidze said. Given that rent payments serve as income for landlords, those property owners may have less revenue to draw on for their own mortgage payments. Furthermore, kicking a tenant out of an apartment in the eye of an economic downturn will mean landlords may have a tough time finding a replacement, he added.

“That could lead to a decrease in home values, even in the owner-occupied market, and in every state and every city there’s a patchwork of different, you know, kind of laws that people are using. So, really, it’s necessary that we have a federal plan,” the economist said. “We need a federal plan to deal with this rental crisis or it’s going to get worse.”

The eviction crisis could be a boon, however, for eviction services, said Glenn Kelman, chief executive of real estate brokerage Redfin, in an appearance later Friday on “Closing Bell.” He is also hoping society will intervene in what he said could turn into a “social calamity.”

“If you look at the data right now, about 8% of mortgages are in forbearance. That’s the program that lets you defer a mortgage payment for about a year. In January, the delinquency rate was about 3%,” Kelman said. “Clearly, the people in the business of evicting folks out of apartments and houses, of handling delinquencies and foreclosures are anticipating a big 2021 and that’s one of the shoes that we’re really worried could drop next year.”

About 30 million people are believed to be collecting unemployment benefits as the U.S. economy attempts to recover from a recession-inducing lockdown. Meanwhile, the countrywide Covid-19 outbreak shows no signs of ebbing, as virus cases in the U.S. now top 4.5 million and deaths near 153,000, according to data compiled by Johns Hopkins University as of Friday afternoon.

While an extra $ 600 in weekly jobless benefits, on top of state unemployment insurance, funded by the federal government has helped workers keep their heads above water, the measure has now lapsed. Democratic and Republican lawmakers are at a standoff over whether to replenish those funds, either partially or in full.

The Republican-controlled Senate failed this week to pass a new coronavirus relief package that would have reduced the weekly federal unemployment pay from $ 600 to $ 200 and later transition the program to a partial wage replacement system. The chamber has since adjourned for the weekend.

In order to fend off a larger crisis, it is vital that Congress continue paying out additional unemployment benefits and implement a national moratorium on evictions as the economy rebounds, Kapfidze contended.

“It’s really tragic when you look at how well other countries have handled this crisis that the United States has failed so dismally. It’s sad,” he said. “People need a lot of help out there, or we’re all going to be in trouble.”