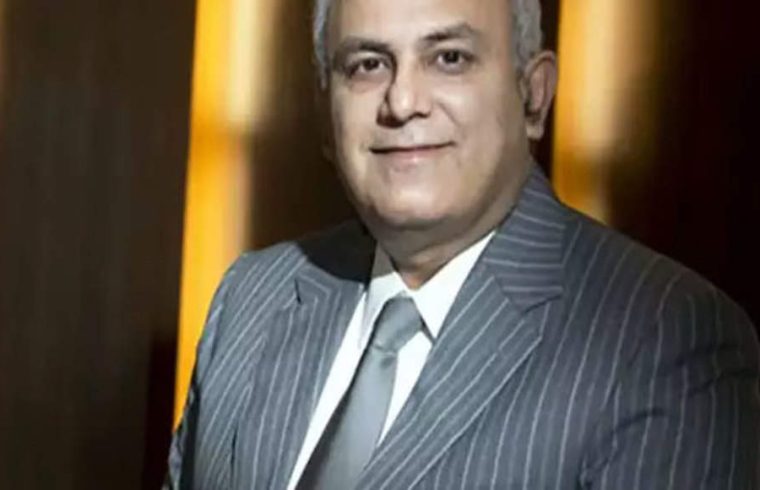

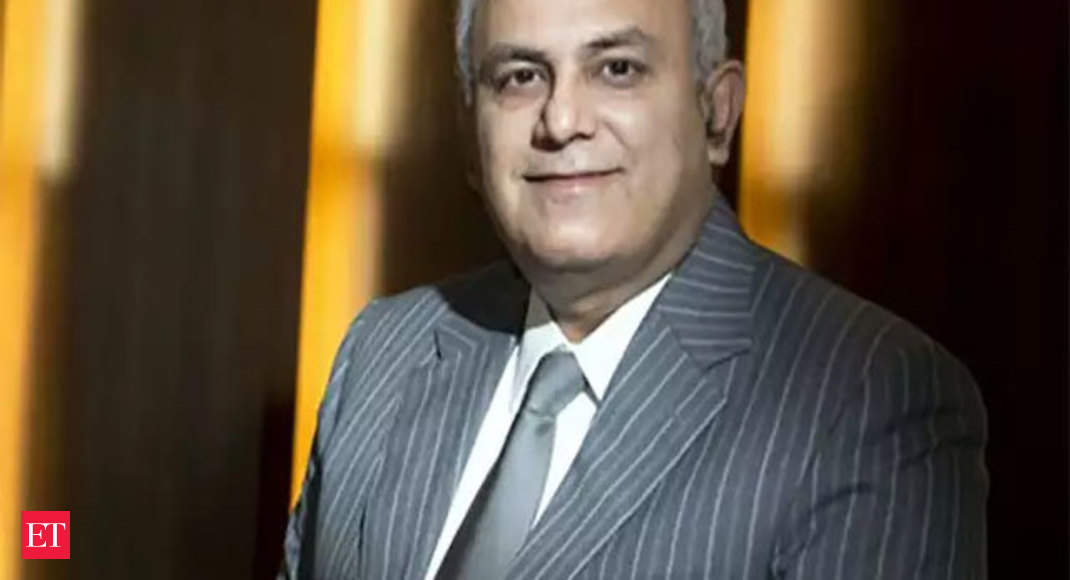

Mumbai-based RBL Bank has set aside enough capital buffers to deal with the Covid-19 pandemic crisis and is confident credit costs will not exceed levels seen in the previous financial year, CEO Vishwavir Ahuja told ET in an interview. The bank is already seeing higher spends on credit cards and is sure its micro finance portfolio will bounce back, Ahuja said. Edited excerpts.

Will you need more in terms of provisions to deal with the crisis?

We have done more than enough. We have taken a very conservative scenario and things are happening sooner than we assumed. There is already some lifting of the lockdown in green and orange zones, whereas we had assumed a complete lockdown till early June. Now, there is huge clamour for economic activity to be lifted sooner than later. All that augurs well for our assumptions. We have completely stress-tested our portfolio. Even on the higher side, our credit costs for FY21 will be around the FY20 number. We have taken additional provisions of 17 basis points for Covid-19 and another 30 basis points to increase provision coverage…we are confident that things will be better than our guidance.

What about the bank’s profitability in the next fiscal year?

Our profitability will be better for FY21 than FY20. In our credit card business, the spends are going up already in the first days of May versus April. In the prevailing circumstances, it may be the game-changer because the desire for consumption is there. Soon, a whole range of non-essential items will be opened up for home delivery through online and card usage will go up. You may not spend for travel and tourism, but you will spend for other items. Consumption of essentials is already much higher than earlier. We are very confident of a V-shaped bounce back for the card business and that is where our upside exists. People are also willing to make payments when earlier they had sought a moratorium, which is a good sign. Even on the corporate business, we are starting on a completely clean slate…there will be some risks due to the Covid-19 outbreak but that is again minimal because our relative exposure to these sectors is very little.

What about micro finance loans and the MSME business?

Our total MSME portfolio is about 1.5% to 2% of our book. Non-wholesale book is 55%. In micro banking, the scenario is most positive compared to other segments. We had given moratorium to 100% of borrowers, but from May 4 we started opening rural branches. We have opened 700 already. Rural India has not been impacted much with 90% in green zones. We financed local livelihoods and economic activity that has no linkages to urban centres. These customers are eager to get going once again. We are already seeing signs of normalcy and we expect to open all branches by the end of this month. Between credit cards and micro banking business, which make up 28% of our portfolio, they will show some growth this year. But, we are watching the small business collateralised loans because of the impact of the outbreak.

You saw some deposit outflows in March…

Since March, whatever we lost have all been recovered. In one month alone, we had a 4% bump up with Rs 2,500 crore of new deposits happening to Rs 60,300 crore of total deposits as of April 30, which will keep growing because 80 new branches were added in the last six months. Our Current Account-Savings Account portfolio has not been affected. The challenge is not deposits but to use the extra liquidity that we are sitting on. Our Liquidity Coverage Ratio is at 165% with Rs 8,000 crore of extra liquidity. But we will have to live through this phase. Our margins will not come down by more than 5 to 10 basis points because our wholesale loan ratio will come down further, cushioning the fall in net interest margins.